How to Ship ‘Delivery From Trader Joe’S’: Costs, Times & Process

Your Complete Guide to delivery from trader joe’s

Navigating the Complexities of Trader Joe’s Delivery

In today’s fast-paced global market, businesses continually face the challenge of sourcing quality products efficiently while managing costs and logistics. For those looking to procure unique offerings from Trader Joe’s, the task becomes even more daunting due to the limited availability of direct delivery options and the nuances of importing specialty goods. Many international shippers, importers, and exporters grapple with understanding how to effectively access Trader Joe’s products, especially when traditional supply chains may not readily accommodate such requests.

This comprehensive guide aims to unravel the complexities of delivery from Trader Joe’s by addressing key areas that impact your logistics strategy. We will delve into various shipping methods available for Trader Joe’s products, exploring options like third-party delivery services, personal shoppers, and the potential of using platforms like Instacart or DoorDash. Each method has its own set of advantages and limitations, which we will outline to help you make informed decisions.

Cost is another critical factor in the delivery equation. We will break down the different pricing structures associated with procuring items from Trader Joe’s, including delivery fees, potential markups from resellers, and strategies to minimize expenses. Understanding these costs can significantly impact your bottom line and influence your sourcing strategy.

Transit times can vary widely based on the delivery method chosen and geographic location. Our guide will provide insights into expected delivery times, allowing you to plan your inventory needs more effectively and avoid potential stockouts.

Customs regulations and import duties are paramount for international businesses. We will highlight essential considerations for importing Trader Joe’s products, including documentation, compliance, and potential challenges that may arise during the customs clearance process.

Lastly, we will address the inherent risks associated with sourcing from Trader Joe’s, such as product availability fluctuations, shipping delays, and the implications of relying on third-party services. By understanding these risks, you can develop contingency plans to safeguard your operations.

By the end of this guide, you will possess expert knowledge that empowers you to navigate the intricacies of delivery from Trader Joe’s efficiently. Whether you are a business owner in Germany, the USA, or the UAE, this information will equip you with the tools needed to streamline your procurement process and enhance your operational effectiveness.

Table of Contents

- Your Complete Guide to delivery from trader joe’s

- Understanding Your Shipping Options: A Detailed Comparison

- Deconstructing the Cost: A Full Pricing Breakdown

- Transit Time Analysis: How Long Will It Take?

- Navigating Customs Clearance: A Step-by-Step Guide

- A Practical Guide to Choosing Your Freight Forwarder

- Incoterms 2020 Explained for Shippers

- Risk Management: Identifying and Mitigating Common Shipping Problems

- Frequently Asked Questions (FAQs) for delivery from trader joe’s

- Conclusion: Key Takeaways for Successful Shipping

- Important Disclaimer

Understanding Your Shipping Options: A Detailed Comparison

Introduction to Shipping Options for Trader Joe’s Delivery

When considering how to facilitate delivery from Trader Joe’s, especially for international shippers, importers, and exporters, it’s essential to evaluate various transportation methods. Each method has its unique strengths, weaknesses, and costs associated with it. This guide will explore different shipping options, providing a detailed comparison and practical insights for businesses looking to optimize their logistics operations.

Overview and Comparison Table

| Shipping Method | Best For | Speed | Cost Level | Key Advantages | Key Disadvantages |

|---|---|---|---|---|---|

| Sea FCL | Large, bulk shipments | Slow (2-6 weeks) | Low | Economical for large volumes, reduced environmental impact | Longer transit times, port delays, limited flexibility |

| Sea LCL | Smaller shipments | Slow (2-6 weeks) | Moderate | Cost-effective for smaller loads, flexible shipping schedules | Higher per-unit costs, potential for cargo damage |

| Air | Time-sensitive shipments | Fast (1-5 days) | High | Quick delivery, reliable schedules, minimal handling | Expensive, limited cargo space, weight restrictions |

| Rail | Domestic shipments | Moderate (1-2 weeks) | Moderate | Cost-effective for land transport, bulk capacity | Limited routes, potential delays due to weather |

| Express | Urgent deliveries | Very fast (same day-3 days) | Very high | Fast, door-to-door service, real-time tracking | Very expensive, limited to smaller shipments |

Detailed Breakdown of Each Method

Sea FCL (Full Container Load)

What It Is: Shipping a full container (20ft or 40ft) dedicated to a single shipment.

When to Use It: Ideal for businesses needing to transport large quantities of goods.

Pros:

– Economical for bulk shipments, reducing the cost per unit.

– Lower environmental impact per ton compared to air freight.

– Less handling of goods, minimizing damage risks.

Cons:

– Long transit times (2-6 weeks), making it unsuitable for time-sensitive goods.

– Vulnerability to port congestion and customs delays.

– Requires significant planning and inventory management.

Sea LCL (Less than Container Load)

What It Is: Shipping smaller quantities of goods that do not fill an entire container.

When to Use It: Best for businesses with smaller shipments that do not justify a full container.

Pros:

– Cost-effective for smaller shipments, allowing for shipping flexibility.

– Access to a wider range of shipping schedules.

Cons:

– Higher per-unit shipping costs compared to FCL.

– Increased risk of cargo damage due to handling by multiple parties.

– Potential for longer transit times due to consolidation processes.

Air Freight

What It Is: Transporting goods by aircraft, suitable for urgent shipments.

When to Use It: Ideal for time-sensitive deliveries, such as seasonal products or perishable goods.

Pros:

– Fast delivery times (1-5 days), ensuring timely arrival.

– Reliable schedules and minimal handling.

– Excellent tracking capabilities.

Cons:

– High shipping costs, making it less viable for large volumes.

– Limited cargo space and weight restrictions.

– Environmental impact is significantly higher than sea freight.

Rail Freight

What It Is: Transporting goods via train, predominantly used for domestic shipping.

When to Use It: Suitable for bulk shipments across land, especially in regions with established rail networks.

Pros:

– Cost-effective for bulk land transport with a lower environmental footprint.

– Reliable schedules and reduced risk of damage.

Cons:

– Limited routes compared to trucking, which can affect flexibility.

– Potential delays due to weather conditions or track maintenance.

– Not suitable for urgent deliveries.

Express Shipping

What It Is: A premium shipping option for urgent deliveries, often door-to-door.

When to Use It: Best for businesses requiring immediate product availability.

Pros:

– Extremely fast delivery times (same day to 3 days).

– Real-time tracking and door-to-door service.

Cons:

– Very high costs, making it impractical for bulk shipments.

– Limited to smaller packages, often not suitable for large volumes.

Special Considerations

Multimodal Transport

Multimodal transport refers to using two or more modes of transport to move goods. This method can optimize costs and transit times by combining the strengths of different shipping methods. For instance, a business might use sea freight for the majority of the journey and then switch to rail or truck for the final delivery. This approach can be particularly advantageous for balancing cost and speed, especially for international shipments.

Specialized Options

-

RoRo (Roll-on/Roll-off): This method is used for transporting wheeled cargo like vehicles. It involves driving the vehicles directly onto the vessel, making it efficient and cost-effective for automotive shipping.

-

Break Bulk: This method involves shipping large, heavy items that cannot fit in standard containers. It’s useful for oversized machinery or construction equipment but can be more expensive due to the extra handling required.

Conclusion

Choosing the right shipping method for delivering products from Trader Joe’s involves a careful consideration of various factors, including the size and urgency of the shipment, cost implications, and the specific needs of the business. Understanding the advantages and disadvantages of each transportation method is crucial for optimizing logistics strategies and ensuring timely and cost-effective delivery. By leveraging multimodal transport and specialized options, businesses can further enhance their shipping efficiency, ensuring they meet customer demands effectively.

Deconstructing the Cost: A Full Pricing Breakdown

Understanding the Cost Structure of Trader Joe’s Delivery

When considering the logistics of delivering goods from Trader Joe’s, especially for international shippers, importers, exporters, and business owners, it’s essential to understand the various cost components involved. The pricing structure for delivery services can be intricate, reflecting numerous factors and charges that accumulate from the point of origin to the destination. Below, we dissect these costs into primary categories and provide insights into each component’s pricing factors.

Main Cost Components

- Main Freight

-

This is the primary cost associated with the transportation of goods from Trader Joe’s distribution centers to the consumer’s location. It encompasses both sea freight and air freight, depending on the urgency and nature of the shipment.

-

Origin Charges

-

These are fees incurred at the point of departure. They may include loading, handling, and administrative costs associated with preparing the goods for transport.

-

Destination Charges

- Once the goods arrive at the destination, various charges are applied. These can include unloading, customs clearance, and local delivery fees.

Detailed Cost Factor Analysis

Main Freight

Main freight costs are influenced by several factors, including:

- Type of Freight: Sea freight is generally cheaper than air freight but takes longer. The choice between Less than Container Load (LCL) and Full Container Load (FCL) also impacts pricing.

- Distance: The farther the shipment travels, the higher the freight cost. Shipping from regions like Germany or the UAE to the USA will incur different rates based on distance and logistics.

- Weight and Volume: Heavier or bulkier shipments will increase costs. Shipping rates are often calculated based on either the actual weight or the volumetric weight, whichever is higher.

Origin Charges

Origin charges can vary based on:

- Loading Fees: Costs associated with loading goods onto the transport vehicle or vessel.

- Documentation Fees: Charges for preparing necessary shipping documents, including bills of lading and customs declarations.

- Handling Fees: Costs related to the physical handling of goods at the origin, which can vary by location and type of goods.

Destination Charges

Destination charges are determined by:

- Unloading Fees: Charges for unloading goods at the destination.

- Customs Duties and Taxes: Import taxes that may vary significantly depending on the type of goods and the country of import.

- Local Delivery Fees: Costs to transport goods from the port or airport to the final destination, which can be influenced by local distance and traffic conditions.

Example Pricing Table

The following table provides a sample pricing structure for various shipping methods from China to the USA. Please note that these prices are estimates and can fluctuate based on market conditions, fuel prices, and other variables.

| Shipping Method | 20ft Container | 40ft Container | LCL (per cubic meter) | Air Freight (per kg) |

|---|---|---|---|---|

| Estimated Cost | $1,500 | $2,500 | $150 | $5.00 |

Disclaimer: The above pricing is purely illustrative and may vary significantly based on a multitude of factors including but not limited to shipping routes, seasonal demand, and specific service providers.

How to Reduce Costs

For businesses seeking to minimize delivery costs from Trader Joe’s or any other supplier, here are actionable strategies:

-

Optimize Shipment Size: Consolidate shipments to maximize container space. Utilizing FCL can often be more cost-effective than LCL for larger shipments.

-

Negotiate Rates: Build relationships with freight forwarders to negotiate better rates based on your shipping volume and frequency.

-

Utilize Technology: Leverage software solutions for route optimization, inventory management, and freight tracking to improve efficiency and reduce costs.

-

Choose the Right Mode of Transport: Assess the urgency of your shipment. If time allows, sea freight is generally cheaper than air freight.

-

Plan Shipments Ahead of Time: Avoid last-minute shipping decisions that can lead to higher costs. Planning can help you take advantage of lower rates.

-

Consider Alternate Delivery Methods: Explore options such as local delivery services or personal shoppers, which can sometimes provide cost-effective solutions compared to traditional freight methods.

-

Monitor Customs Regulations: Stay updated on customs tariffs and taxes that may apply to your shipments. Proper classification of goods can help in minimizing unexpected charges.

By understanding the detailed cost structure and implementing these strategies, businesses can better navigate the complexities of delivery logistics while optimizing their expenses.

Transit Time Analysis: How Long Will It Take?

Understanding Transit Times for Delivery from Trader Joe’s

When considering the transit times associated with delivery from Trader Joe’s, particularly for international shippers, importers, and exporters, it’s essential to understand the various factors that can influence these times. The process is not merely about placing an order; it involves multiple logistical elements that can significantly impact the timeline from order placement to final delivery.

Factors Influencing Transit Time

-

Shipping Mode: The choice of shipping mode—whether sea freight or air freight—plays a crucial role in determining transit times. Air freight, while more expensive, typically results in much faster delivery times compared to sea freight, which can take several weeks but is more cost-effective for bulk shipments.

-

Port Congestion: Congestion at ports can lead to delays in loading and unloading cargo. This is particularly relevant in peak seasons, such as holidays, when shipping volumes surge. Ports with higher congestion levels may experience longer waiting times for vessels to dock and unload.

-

Customs Clearance: Customs procedures can add significant time to the transit process. Each shipment must go through customs inspections, which can vary in duration based on the country of origin, destination regulations, and the type of goods being shipped. Proper documentation and compliance with import/export regulations can expedite this process.

-

Shipping Routes: The chosen shipping route can affect transit time. Direct routes generally take less time than those with multiple stops or transshipments. Additionally, geopolitical factors or regional conflicts can necessitate route changes, adding to the overall delivery time.

-

Weather Conditions: Weather can impact shipping schedules, especially for air freight, where adverse conditions can lead to flight cancellations or delays. Similarly, sea freight can be affected by storms or rough seas, which can slow down vessel movement.

Estimated Transit Time Table

| Origin | Destination | Sea Freight (Days) | Air Freight (Days) |

|---|---|---|---|

| China | USA | 25-40 | 5-10 |

| Germany | USA | 20-30 | 4-8 |

| UAE | USA | 15-25 | 3-7 |

| USA | Germany | 25-35 | 5-10 |

| USA | UAE | 20-30 | 4-8 |

| China | Germany | 30-45 | 6-12 |

Context and Explanation

The estimates provided in the table above are port-to-port transit times and do not account for additional logistical elements such as inland transportation, order processing time, or any potential delays due to customs clearance.

For businesses planning to import goods from Trader Joe’s, it is crucial to factor in these additional time considerations. For instance, while air freight may offer quicker transit times, it also tends to come with higher costs. Businesses should evaluate their urgency against budget constraints when choosing between shipping modes.

Additionally, it is advisable to maintain flexibility in planning. Given the unpredictability of factors like weather and port congestion, allowing for buffer time in logistics planning can help mitigate the impact of delays. Businesses should stay informed about global shipping trends and potential disruptions to better anticipate challenges in their supply chains.

In conclusion, understanding the factors that influence transit times and planning accordingly can greatly enhance the efficiency of international shipping operations. By carefully evaluating shipping options and remaining adaptable to changing conditions, importers and exporters can navigate the complexities of global logistics more effectively.

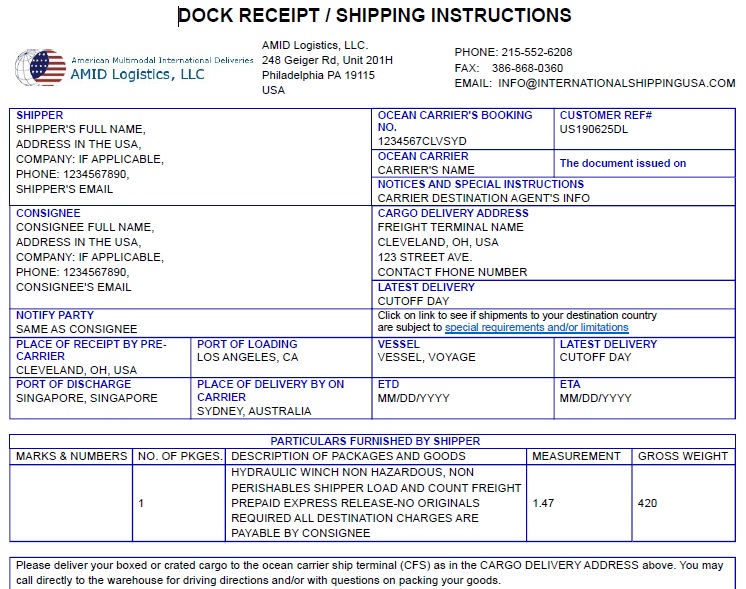

Navigating Customs Clearance: A Step-by-Step Guide

The Process Explained

Navigating customs clearance can often feel daunting, especially when dealing with international shipments from retailers like Trader Joe’s. However, understanding the workflow can simplify the process significantly. Here’s a step-by-step guide:

-

Preparation of Shipment: Before your goods leave Trader Joe’s, ensure that all items are properly packaged and labeled. This is essential for smooth customs clearance. Use appropriate materials to protect your goods and make sure they are easy to identify.

-

Gather Required Documentation: Collect all necessary documents. These will vary depending on the destination country and type of goods but typically include a commercial invoice, packing list, and bill of lading.

-

Customs Declaration: Complete the customs declaration forms required by the destination country. This document provides customs with information about the shipment, including the nature of the goods, their value, and the sender’s details.

-

Payment of Duties and Taxes: Calculate and pay any applicable duties and taxes. This can be done through the customs authority of the destination country. Ensure you understand how these fees are calculated to avoid surprises.

-

Customs Inspection: Your shipment may be subject to inspection by customs officials. They will verify the contents against the declaration to ensure compliance with regulations. Be prepared for this possibility, and ensure all documentation is readily available.

-

Release of Goods: Once cleared, customs will release your goods for delivery. Make arrangements for the final leg of the shipment, whether it’s through a freight forwarder or direct delivery.

-

Final Delivery: The last step is the delivery of your goods to the final destination. Ensure that you have a reliable logistics partner to handle this last mile efficiently.

Essential Documentation

Proper documentation is critical for ensuring smooth customs clearance. Below are the key documents you will need:

-

Commercial Invoice: This document acts as a bill for the goods from the seller to the buyer. It includes details such as the description of the goods, their value, and terms of sale. It is essential for calculating duties and taxes.

-

Packing List: A packing list provides a detailed account of the contents of each package. It includes information such as item quantities, weight, dimensions, and any special handling instructions. Customs uses this document to verify that the shipment matches the commercial invoice.

-

Bill of Lading (BOL): The BOL is a contract between the shipper and the carrier. It serves as a receipt for the goods and outlines the terms of the transport. The BOL is crucial for tracking the shipment and for customs purposes.

-

Customs Declaration Form: This form provides customs officials with information about the goods being imported, including their value, quantity, and purpose. It is essential for the customs clearance process.

-

Certificates of Origin: Depending on the nature of the goods, you may need to provide a certificate of origin, which certifies the country in which the goods were manufactured. This can affect duty rates and import restrictions.

Duties, Taxes, and HS Codes

Understanding duties, taxes, and HS codes is essential for accurate customs clearance.

-

HS Codes: The Harmonized System (HS) code is an internationally standardized system of names and numbers used to classify traded products. Each item is assigned a specific code that helps customs authorities determine the applicable duties and taxes. Make sure to accurately classify your goods to avoid delays.

-

Duties and Taxes Calculation: Duties are typically calculated based on the value of the goods as stated in the commercial invoice and the HS code classification. Each country has its own tariff schedule, which outlines the duty rates for different categories of goods. Taxes such as VAT (Value Added Tax) or GST (Goods and Services Tax) may also apply, depending on the destination country’s regulations. Be sure to consult the customs authority’s website or a customs broker for specific rates.

Common Problems & Solutions

While customs clearance can be straightforward, several common issues can arise. Here are some potential problems and their solutions:

-

Incomplete Documentation: One of the most common reasons for customs delays is incomplete or incorrect documentation. Solution: Double-check all documents before submission. Utilize a checklist to ensure you have all necessary paperwork.

-

Incorrect HS Code: Misclassification of goods can lead to penalties or increased duties. Solution: Take the time to research and verify the correct HS code for your products. Consulting with a customs broker can also be beneficial.

-

Unpaid Duties and Taxes: Shipments can be held at customs if duties and taxes are not paid promptly. Solution: Calculate and pay duties and taxes in advance, if possible. Keep records of all payments and transactions.

-

Customs Inspection Delays: Random inspections can delay shipments, causing frustration. Solution: Ensure all documentation is accurate and complete to minimize the chance of delays. Being prepared with all paperwork can expedite the inspection process.

-

Miscommunication with Freight Forwarders: Poor communication can lead to errors in the shipping process. Solution: Establish clear communication channels with your freight forwarder and ensure they have all necessary information regarding your shipment.

Navigating customs clearance may seem complex, but by following these steps and being well-prepared, you can streamline the process and ensure a successful delivery from Trader Joe’s.

A Practical Guide to Choosing Your Freight Forwarder

Key Qualities to Look for in a Freight Forwarder

When selecting a freight forwarder for your Trader Joe’s delivery needs, especially if you’re an international shipper, importer, or exporter, several key attributes can significantly influence your logistics experience. Here are the essential qualities to consider:

-

Experience and Expertise: Look for a freight forwarder with a proven track record in the grocery and specialty foods sector. Their familiarity with the unique challenges of handling perishable goods, specialty items, and fluctuating inventory is crucial.

-

Global Network: Your freight forwarder should have an extensive network of carriers and agents across the regions you are shipping to and from. This network is vital for ensuring timely deliveries and managing any unforeseen logistical challenges.

-

Licensing and Compliance: Ensure that the freight forwarder is properly licensed and compliant with local and international regulations. This includes certifications such as IATA for air freight and FMC for ocean freight in the U.S. Additionally, check if they have experience with customs regulations, especially for food products.

-

Transparent Communication: Effective communication is essential in logistics. Your freight forwarder should provide regular updates regarding shipment status, potential delays, and any issues that may arise. Look for a partner that prioritizes responsiveness and clarity.

-

Technology Utilization: A forwarder that employs advanced technology for tracking shipments, managing inventory, and providing real-time updates can enhance your logistics operations. This capability can be particularly useful when coordinating deliveries for time-sensitive products from Trader Joe’s.

-

Customized Solutions: Every business has unique needs. A good freight forwarder should be able to offer tailored solutions that fit your specific requirements, whether it’s managing special handling for fragile items or optimizing shipping routes for cost efficiency.

Sourcing Checklist

To ensure you choose the right freight forwarder for your Trader Joe’s deliveries, follow this structured checklist:

-

Define Your Needs: Clearly outline your shipping requirements, including the type of products (e.g., frozen goods, snacks), shipment volume, and destination locations. Consider seasonal fluctuations in demand, especially for specialty items.

-

Research Potential Forwarders: Compile a list of potential freight forwarders. Use online resources, industry directories, and recommendations from peers in your business sector to identify reputable candidates.

-

Request Quotes: Contact the shortlisted freight forwarders to request quotes. Ensure that the quotes include all potential costs, such as shipping fees, insurance, customs duties, and any additional services offered.

-

Ask Questions: Engage with potential forwarders by asking targeted questions. Inquire about their experience with similar products, their approach to handling perishables, and their contingency plans for delays or disruptions.

-

Check References: Request references from past clients, particularly those in the grocery or specialty foods industry. Speak directly with these references to gauge their experiences and satisfaction with the freight forwarder’s services.

Red Flags to Watch Out For

While evaluating potential freight forwarders, be mindful of warning signs that may indicate a poor fit for your needs:

-

Lack of Experience in Your Industry: If a forwarder has little to no experience handling grocery or perishable goods, it may lead to complications in shipping and compliance.

-

Poor Communication: If a freight forwarder is slow to respond to inquiries or fails to provide clear information, this could be a sign of future communication issues.

-

Opaque Pricing: Be cautious of freight forwarders that provide vague quotes or refuse to break down costs. Transparency in pricing is critical to avoid unexpected charges.

-

Limited Network: A freight forwarder with a restricted network may struggle to find the best shipping routes or carriers, leading to delays and higher costs.

-

Negative Reviews: Conduct thorough research on potential forwarders. Consistent negative feedback regarding service quality, delays, or customer service should raise concerns.

-

Inflexibility: If a freight forwarder cannot accommodate your specific needs or adapt to changing circumstances, they may not be the best partner for your business.

By adhering to this guide, you can make an informed decision when selecting a freight forwarder for your Trader Joe’s delivery requirements, ensuring a smooth and efficient logistics process that aligns with your business objectives.

Incoterms 2020 Explained for Shippers

Understanding Incoterms for Efficient Delivery from Trader Joe’s

Incoterms, or International Commercial Terms, are a set of predefined rules established by the International Chamber of Commerce (ICC) that clarify the responsibilities of buyers and sellers in international transactions. These terms define aspects such as who pays for shipping, where the risk transfers from seller to buyer, and the obligations of each party during the shipping process. For businesses involved in importing and exporting, understanding Incoterms is crucial for managing logistics, costs, and risk effectively.

Key Incoterms Table

| Incoterm | Who Pays for Transport? | Where Risk Transfers? | Best for |

|---|---|---|---|

| EXW | Buyer | At the seller’s premises | Buyers who want control |

| FOB | Seller | At the ship’s rail | Buyers looking for cost-effectiveness |

| CIF | Seller | Upon unloading at port | Buyers wanting insurance coverage |

| DDP | Seller | At buyer’s premises | Buyers wanting full service |

Detailed Explanation of Common Incoterms

EXW (Ex Works)

In an EXW arrangement, the seller makes the goods available at their premises or another named place (factory, warehouse, etc.), and the buyer assumes all responsibility for transporting the goods from that point. This includes loading, transport, insurance, and customs clearance. For example, if Trader Joe’s were to sell their products to an international importer under EXW terms, the importer would need to arrange and pay for all transport from the Trader Joe’s distribution center to their destination, effectively placing the onus of logistics on the buyer.

FOB (Free on Board)

Under FOB terms, the seller is responsible for all costs and risks until the goods are loaded onto the transport vessel at the designated port. Once the goods are on board, the risk transfers to the buyer, who must then handle shipping costs and insurance from that point onward. If an importer orders bulk items from Trader Joe’s and specifies FOB shipping, Trader Joe’s would handle all logistics up to the loading of the goods onto the ship, while the importer would be responsible for the journey across the ocean and any related costs once the goods are loaded.

CIF (Cost, Insurance, and Freight)

CIF terms require the seller to cover the costs of transport, insurance, and freight to a specified destination port. The risk transfers to the buyer once the goods are loaded, but the seller remains responsible for the insurance during transit. If Trader Joe’s were to ship products internationally under CIF terms, they would need to arrange and pay for the shipping and insurance, offering the buyer peace of mind knowing that their goods are protected during transit until they arrive at the destination port.

DDP (Delivered Duty Paid)

DDP represents the maximum obligation for the seller, who bears all costs and risks associated with transporting the goods to the buyer’s location, including customs duties and taxes. The seller must ensure that the goods are delivered to the buyer’s premises without any additional charges. If Trader Joe’s were to sell their products under DDP terms, they would manage everything from shipping to customs clearance and deliver the items directly to the buyer’s door, making it an attractive option for those who prefer a hassle-free purchasing process.

Conclusion

Understanding Incoterms is essential for businesses engaged in international shipping, including those looking to import goods from retailers like Trader Joe’s. By clearly defining the responsibilities of buyers and sellers, these terms help streamline logistics, mitigate risks, and ensure compliance with international trade laws. Whether you are a buyer looking for control (EXW), cost savings (FOB), insurance coverage (CIF), or a comprehensive delivery solution (DDP), knowing which Incoterm to use can significantly impact your shipping experience.

Risk Management: Identifying and Mitigating Common Shipping Problems

Importance of Proactive Risk Management

In the fast-paced world of logistics and shipping, particularly for businesses dealing with perishable goods like those offered by Trader Joe’s, proactive risk management is essential. By identifying potential risks and implementing effective mitigation strategies, businesses can safeguard their operations against unforeseen disruptions. This not only protects the integrity of shipments but also enhances customer satisfaction, maintains brand reputation, and minimizes financial losses. As international shippers, importers, and exporters navigate complex global supply chains, understanding and addressing risks becomes paramount to ensure smooth delivery processes.

Risk Analysis Table

Below is a risk analysis table that outlines common shipping problems associated with the delivery of goods from Trader Joe’s, their potential impacts, and suggested mitigation strategies.

| Potential Risk | Impact | Mitigation Strategy |

|---|---|---|

| Cargo Damage | Loss of product quality, financial loss, and potential customer complaints. | – Use high-quality packaging materials. – Implement handling training for staff. – Conduct regular inspections. |

| Delays | Late deliveries can lead to customer dissatisfaction and lost sales. | – Use real-time tracking systems. – Maintain open communication with logistics partners. – Build buffer times into delivery schedules. |

| Customs Holds | Extended delivery times and potential fines or additional charges. | – Ensure all documentation is accurate and complete. – Partner with experienced customs brokers. – Stay updated on international shipping regulations. |

| Inventory Shortages | Inability to meet customer demand, leading to lost sales opportunities. | – Maintain accurate inventory management systems. – Implement regular forecasting and demand analysis. – Establish relationships with multiple suppliers. |

| Regulatory Compliance | Legal penalties and shipment rejections that can disrupt supply chains. | – Stay informed on the latest shipping regulations. – Conduct regular training for staff on compliance issues. – Utilize compliance management software. |

Cargo Insurance Explained

What Cargo Insurance Covers

Cargo insurance is a crucial safety net for businesses involved in shipping goods, particularly for products that are perishable or sensitive to handling, like those from Trader Joe’s. It provides coverage for a variety of risks, including:

- Damage to Goods: Protection against physical damage that may occur during transit due to accidents, weather conditions, or mishandling.

- Loss of Goods: Coverage for complete loss of cargo, whether due to theft, sinking, or other unforeseen circumstances.

- Delay in Delivery: Compensation for financial losses incurred due to delays in delivery, which can be especially detrimental for perishable goods.

- Liability for Third-Party Claims: Protection against claims made by third parties for damages related to the cargo.

Types of Cargo Insurance

- All-Risk Insurance: Covers all types of loss or damage unless specifically excluded in the policy. This is the most comprehensive form of coverage.

- Named Perils Insurance: Only covers losses caused by specific risks named in the policy, such as theft or fire. This is typically less expensive but offers limited protection.

- General Average Insurance: Applies in situations where cargo is sacrificed for the safety of the ship and remaining cargo. All parties share the costs of the loss.

Why Cargo Insurance is Essential

Investing in cargo insurance is not just a precaution; it is a vital component of a robust risk management strategy. Here are several reasons why it is essential:

- Financial Protection: It safeguards against significant financial losses that can arise from damaged or lost goods, which is particularly important for businesses with tight margins.

- Peace of Mind: Knowing that your goods are insured allows businesses to operate with confidence, focusing on growth rather than potential setbacks.

- Client Trust: Having cargo insurance can enhance customer trust and satisfaction, as it demonstrates a commitment to protecting their interests and ensuring product quality.

- Legal Compliance: In some regions, having insurance for goods in transit may be a legal requirement, ensuring compliance with local laws.

Conclusion

In the realm of international shipping and delivery, especially for products from Trader Joe’s, proactive risk management and comprehensive cargo insurance are indispensable. By identifying potential risks and implementing effective mitigation strategies, businesses can enhance their operational resilience, ensure timely deliveries, and maintain the quality of their offerings. As the logistics landscape continues to evolve, staying informed and prepared will empower shippers and businesses to navigate challenges and seize opportunities with confidence.

Frequently Asked Questions (FAQs) for delivery from trader joe’s

1. Does Trader Joe’s offer delivery services internationally?

Currently, Trader Joe’s primarily provides delivery services within the United States through platforms like DoorDash and Instacart. International shipping options are not available directly through Trader Joe’s, limiting access for businesses and individuals outside the U.S.

2. What are the primary platforms for ordering Trader Joe’s delivery?

Trader Joe’s partners with third-party services like DoorDash and Instacart for delivery. Users can browse the menu and place orders through these platforms, which provide local delivery from nearby Trader Joe’s stores.

3. How long does it typically take to receive a Trader Joe’s delivery?

Delivery times can vary based on factors such as distance from the store, traffic conditions, and time of day. On average, deliveries take around 40 minutes. Customers can track their order in real-time through the respective delivery app.

4. Can I customize my Trader Joe’s order when using delivery services?

Yes, when placing an order through platforms like DoorDash or Instacart, customers may have the option to leave specific instructions or notes for certain items. However, the level of customization may depend on the platform’s capabilities.

5. Are there any additional fees for Trader Joe’s delivery?

Delivery fees may apply when ordering through third-party platforms. Some services offer subscription models, like DoorDash’s DashPass, which can waive delivery fees for eligible orders, although service fees and minimum order amounts may still apply.

6. What should I do if an item I ordered from Trader Joe’s is unavailable?

In the event that an item is unavailable, platforms like Instacart and DoorDash may suggest substitutes based on your preferences. However, customers should be aware that due to Trader Joe’s unique inventory practices, replacements might not always reflect the original choice.

7. How does Trader Joe’s manage its inventory for delivery?

Trader Joe’s maintains a dynamic inventory system, receiving multiple deliveries each day. This means that item availability can change rapidly, complicating the logistics of ensuring consistent delivery services. As a result, not all items may be available for delivery at all times.

8. What are the customs and import considerations for international buyers interested in Trader Joe’s products?

For international shipping, importers must consider customs regulations, duties, and taxes applicable in their respective countries. Trader Joe’s does not handle international shipping, so businesses will need to use third-party logistics providers to navigate customs requirements.

9. How can businesses ensure compliance with customs bonds when importing Trader Joe’s products?

Businesses looking to import Trader Joe’s products must secure a customs bond through a licensed customs broker. This bond ensures compliance with U.S. Customs and Border Protection regulations, facilitating the clearance of goods at ports.

10. What is the difference between a Bill of Lading (BOL) and an Air Waybill (AWB) in logistics?

A Bill of Lading (BOL) is a document used for shipping goods via land or sea, serving as a receipt and contract between the shipper and carrier. An Air Waybill (AWB), on the other hand, is specific to air freight and acts as a contract for the transportation of goods by air. Both documents are critical for tracking shipments and ensuring compliance with logistics regulations.

Conclusion: Key Takeaways for Successful Shipping

Strategic Planning is Essential

Successful shipping hinges on effective planning. Businesses must assess their logistics capabilities, understand their target markets, and establish clear delivery timelines. For international shippers, it is crucial to consider customs regulations, tariffs, and documentation requirements to avoid costly delays. Companies should also analyze the demand for Trader Joe’s products in their regions, ensuring they stock popular items while minimizing excess inventory.

Collaborate with Reliable Partners

Choosing the right partners for shipping and delivery can significantly impact efficiency and cost-effectiveness. For instance, leveraging third-party delivery services like DoorDash or Instacart can provide access to Trader Joe’s products without the complexities of direct sourcing. Establishing relationships with local couriers or personal shopping services can also enhance delivery options. Collaboration with logistics firms that specialize in international shipping can facilitate smoother customs clearance and timely delivery, which is vital for maintaining customer satisfaction.

Cost Management is Crucial

Understanding and managing costs associated with shipping is paramount. Businesses should evaluate shipping fees, packaging costs, and potential surcharges, particularly when dealing with perishable goods. Implementing strategies such as bulk purchasing or negotiating rates with carriers can reduce expenses. Additionally, businesses should be transparent with customers regarding delivery costs, as this fosters trust and encourages repeat purchases.

Take Action Today

In conclusion, successful shipping from Trader Joe’s or any other retailer requires diligent planning, strategic partnerships, and effective cost management. By focusing on these key areas, businesses can streamline their logistics processes and enhance their competitiveness in the market. Now is the time to take action—evaluate your shipping strategy, explore potential partnerships, and optimize your logistics operations. The future of your business depends on it!

Important Disclaimer

⚠️ Important Disclaimer

The information in this guide is for educational purposes only and does not constitute professional logistics advice. Rates, times, and regulations change frequently. Always consult with a qualified freight forwarder for your specific needs.