The Definitive Guide to Shipping Rates To India From Us: Rates, Tra…

Your Complete Guide to shipping rates to india from us

Understanding the Challenge of Shipping to India

For businesses looking to expand their reach into the Indian market, one of the most significant hurdles lies in navigating the complexities of shipping rates from the U.S. to India. The intricacies involved in international shipping can be daunting—ranging from fluctuating costs to varying delivery times and stringent customs regulations. For importers and exporters alike, understanding these dynamics is crucial for maintaining profitability and ensuring customer satisfaction.

Key Areas Covered in This Guide

In this comprehensive guide, we will dissect the various components that influence shipping rates from the U.S. to India. We will explore:

-

Shipping Methods: Different shipping options available, including express, standard, and freight services, and how each affects cost and delivery speed.

-

Shipping Costs: A breakdown of the factors that determine shipping costs, such as weight, dimensions, and the nature of the goods being transported. We will also provide insights into how to obtain accurate shipping quotes from carriers like DHL, FedEx, and USPS.

-

Transit Times: Understanding the expected delivery times based on your chosen shipping method and the implications of expedited versus standard shipping on your business operations.

-

Customs Regulations: A deep dive into the customs processes that your shipments must go through upon arrival in India, including the necessary documentation and duties that may apply. We will clarify the importance of compliance and how to avoid common pitfalls that can lead to delays.

-

Risks and Mitigation: An overview of potential risks associated with international shipping, including loss, damage, and customs holds, along with strategies to mitigate these risks effectively.

Empowering Your Shipping Decisions

By the end of this guide, you will be equipped with the expert knowledge necessary to navigate the complexities of shipping rates from the U.S. to India. Whether you are a seasoned international shipper or just beginning to explore opportunities in India, this resource will empower you to make informed decisions, streamline your shipping processes, and enhance your overall efficiency. With the right insights at your fingertips, you can confidently tackle the challenges of international shipping and position your business for success in one of the world’s fastest-growing markets.

Table of Contents

- Your Complete Guide to shipping rates to india from us

- Understanding Your Shipping Options: A Detailed Comparison

- Deconstructing the Cost: A Full Pricing Breakdown

- Transit Time Analysis: How Long Will It Take?

- Navigating Customs Clearance: A Step-by-Step Guide

- A Practical Guide to Choosing Your Freight Forwarder

- Incoterms 2020 Explained for Shippers

- Risk Management: Identifying and Mitigating Common Shipping Problems

- Frequently Asked Questions (FAQs) for shipping rates to india from us

- Conclusion: Key Takeaways for Successful Shipping

- Important Disclaimer

Understanding Your Shipping Options: A Detailed Comparison

Overview of Shipping Methods to India

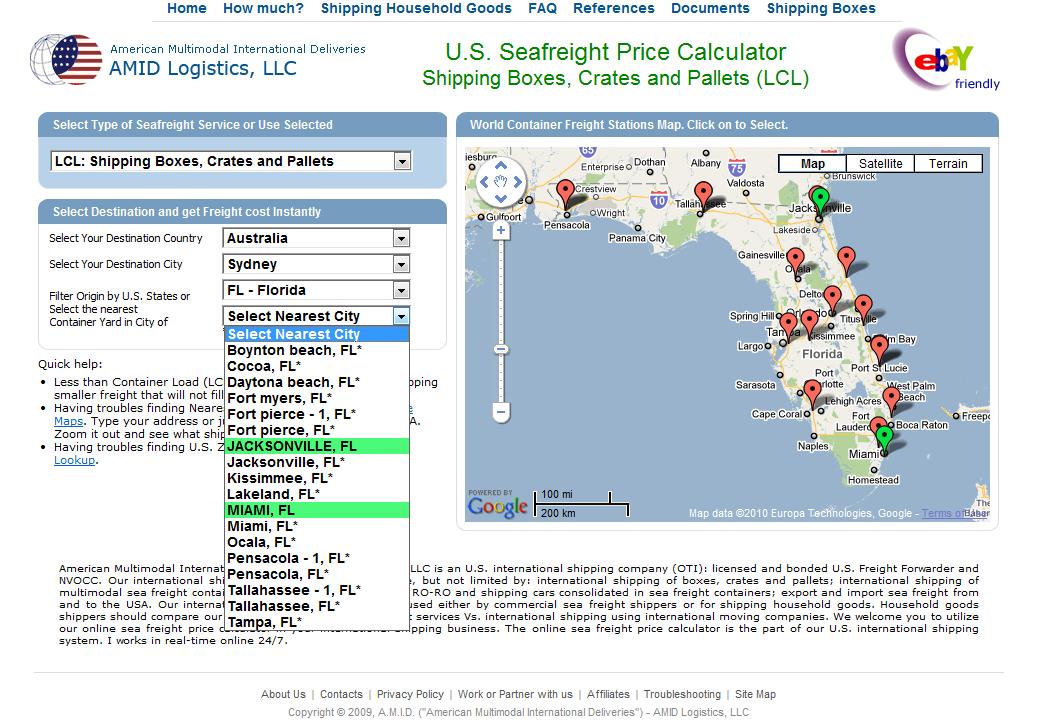

When shipping goods from the United States to India, understanding your shipping options is crucial to optimize costs and delivery times. Each method has its unique characteristics, advantages, and limitations. Below is a detailed comparison of the most common shipping methods: Full Container Load (FCL), Less than Container Load (LCL), Air Freight, Rail, and Express Services. This guide will help you choose the best shipping option based on your specific needs.

Comparison Table of Shipping Methods

| Shipping Method | Best For | Speed | Cost Level | Key Advantages | Key Disadvantages |

|---|---|---|---|---|---|

| Sea FCL | Large shipments | 20-40 days | Low | Cost-effective for bulk shipments | Longer transit time, less flexible |

| Sea LCL | Smaller shipments | 30-60 days | Moderate | Flexible for small shipments | Higher cost per cubic meter, longer transit |

| Air Freight | Time-sensitive shipments | 1-7 days | High | Fast delivery, ideal for urgent goods | Expensive, weight restrictions |

| Rail | Bulk goods, inland shipping | 2-4 weeks | Moderate | Reliable for heavy and bulk items | Limited routes, slower than air |

| Express Services | Urgent deliveries | 1-3 days | Very High | Fastest option, door-to-door delivery | Very expensive, weight and size limitations |

Detailed Breakdown of Each Method

Sea Freight (FCL and LCL)

Full Container Load (FCL)

– What it is: Shipping method where a shipper rents an entire container for their goods.

– When to use it: Ideal for large shipments that can fill a 20 or 40-foot container.

– Pros:

– Cost-effective for large volumes.

– Lower risk of damage as the container is sealed.

– Cons:

– Longer transit times (20-40 days).

– Requires sufficient volume to justify the cost.

Less than Container Load (LCL)

– What it is: Shipping method where multiple shippers share a single container.

– When to use it: Suitable for smaller shipments that do not fill a full container.

– Pros:

– Cost-effective for small shipments.

– Flexibility in shipping frequency.

– Cons:

– Higher cost per cubic meter compared to FCL.

– Longer transit times (30-60 days) due to consolidation and deconsolidation processes.

Air Freight

- What it is: Shipping method that uses aircraft to transport goods.

- When to use it: Best for time-sensitive shipments or high-value items.

- Pros:

- Fast delivery (1-7 days).

- Ideal for perishable goods and urgent shipments.

- Cons:

- Higher costs compared to sea freight.

- Weight and size restrictions can limit the volume.

Rail Freight

- What it is: Transporting goods via train, primarily used for domestic shipping within the U.S. before shipping internationally.

- When to use it: Effective for bulk goods over land.

- Pros:

- Reliable and efficient for heavy items.

- Lower emissions compared to road transport.

- Cons:

- Limited routes; often requires additional transport to ports.

- Slower than air freight (2-4 weeks).

Express Services

- What it is: Premium shipping service that offers expedited delivery.

- When to use it: Perfect for urgent shipments that require rapid delivery.

- Pros:

- Fastest shipping option (1-3 days).

- Door-to-door service with tracking.

- Cons:

- Significantly higher costs.

- May have weight and size limitations.

Special Considerations

Multimodal Transport

Multimodal transport combines multiple shipping methods for a single shipment, optimizing both cost and delivery time. For instance, a shipment may be transported by rail to a port and then shipped by sea. This method is beneficial for businesses needing flexibility and efficiency in their logistics operations.

Specialized Shipping Options

-

Roll-on/Roll-off (RoRo): This method is used for vehicles and heavy equipment. Goods are driven onto the ship and secured, making loading and unloading easier. It is usually more cost-effective for large vehicles but may not be suitable for all types of cargo.

-

Break Bulk Shipping: This involves transporting cargo that must be loaded individually rather than in containers. It is useful for oversized items or machinery that cannot fit into standard containers. However, it requires more handling, increasing the risk of damage.

Conclusion

Choosing the right shipping method from the U.S. to India depends on various factors such as shipment size, urgency, and budget. While sea freight is more cost-effective for large shipments, air freight is ideal for urgent deliveries. Understanding the nuances of each shipping method, including multimodal and specialized options, will empower businesses to make informed decisions that enhance their logistics strategies. By aligning your shipping method with your business needs, you can optimize costs, improve delivery times, and ultimately enhance customer satisfaction.

Deconstructing the Cost: A Full Pricing Breakdown

Understanding the Costs of Shipping from the U.S. to India

Shipping goods internationally can be a complex process, especially when navigating the costs associated with sending items from the U.S. to India. To help you understand the financial landscape, we’ll break down the primary cost components, analyze the factors influencing these costs, and provide actionable tips to reduce expenses.

Main Cost Components

When shipping to India, the overall cost can be categorized into three primary components:

- Main Freight

- Origin Charges

- Destination Charges

Each of these components plays a crucial role in determining the total shipping cost.

Main Freight

The main freight cost is the base charge for transporting your goods. This can vary significantly based on the chosen mode of transportation—air freight or sea freight.

Influencing Factors:

- Weight and Volume: Heavier and larger shipments typically incur higher costs. Air freight is charged based on weight, while sea freight considers both weight and volume (measured in cubic meters).

- Shipping Method: Air freight is generally more expensive than sea freight due to speed and efficiency. However, it is ideal for time-sensitive shipments.

- Distance: The distance between the shipping origin and destination affects costs. Longer routes tend to be more expensive.

Origin Charges

Origin charges are costs incurred before your shipment leaves the U.S. These may include:

- Packaging and Handling Fees: Costs associated with preparing your goods for shipment, including packing materials and labor.

- Transportation to Port/Airport: The cost of moving goods from your location to the shipping terminal.

- Customs Clearance: Fees for processing export documentation and ensuring compliance with U.S. regulations.

Influencing Factors:

- Shipment Size: Larger shipments may require specialized handling, increasing costs.

- Service Provider: Different freight forwarders have varying fee structures for origin services.

Destination Charges

Once your shipment arrives in India, additional costs will be incurred, known as destination charges. These can include:

- Customs Duties and Taxes: Import duties vary based on the type of goods, their declared value, and applicable Indian tax laws. All items are subject to customs duties; India has no de minimis value, meaning even low-value goods are taxed.

- Unloading and Handling Fees: Charges for unloading your shipment at the destination port or airport and moving it to the final delivery point.

- Delivery Charges: Costs associated with transporting your goods from the port or airport to the final destination.

Influencing Factors:

- Type of Goods: Different products have different duty rates. For example, electronics may face higher tariffs than clothing.

- Value Declaration: The declared value of your goods directly impacts the amount of duty and tax owed.

Example Pricing Table

Below is a sample pricing table for shipping options from the U.S. to India. Please note that these are estimated costs and can vary based on numerous factors.

| Shipping Method | 20ft Container | 40ft Container | LCL (Less than Container Load) | Air Freight (Cost per kg) |

|---|---|---|---|---|

| Estimated Cost | $3,000 | $5,500 | $150 (per cubic meter) | $10 – $15 |

Disclaimer: The prices listed in this table are estimates and may vary based on factors such as the shipping provider, current fuel prices, and specific shipment details. Always obtain a quote from your freight forwarder for accurate pricing.

How to Reduce Costs

Reducing shipping costs is essential for businesses looking to maximize profitability. Here are actionable tips to help you save money when shipping to India:

-

Consolidate Shipments: Combine multiple smaller shipments into one larger shipment to take advantage of economies of scale, particularly with sea freight.

-

Choose the Right Shipping Method: Evaluate the urgency of your shipment. If time allows, consider sea freight over air freight, as it is usually more cost-effective.

-

Negotiate Rates: Work with freight forwarders to negotiate better rates based on your shipping volume or frequency. Building a long-term relationship can lead to discounts.

-

Optimize Packaging: Ensure your goods are packed efficiently to minimize weight and volume, which can significantly reduce shipping costs.

-

Understand Customs Regulations: Familiarize yourself with Indian customs regulations to avoid unexpected duties and taxes. Accurate documentation can help prevent delays and additional costs.

-

Utilize Freight Forwarders: Partner with experienced freight forwarders who can provide valuable insights into cost-saving strategies and help navigate customs.

-

Plan Ahead: Avoid last-minute shipments, which often incur higher costs. Planning your shipping schedule can give you more flexibility in choosing cost-effective options.

Conclusion

Understanding the various cost components and factors influencing shipping rates from the U.S. to India is crucial for businesses aiming to optimize their logistics operations. By analyzing main freight, origin, and destination charges, as well as implementing cost-reducing strategies, businesses can improve their bottom line while ensuring timely deliveries. Always keep abreast of current rates and regulations to make informed shipping decisions that align with your business goals.

Transit Time Analysis: How Long Will It Take?

Understanding Transit Times for Shipping to India from the U.S.

When shipping goods from the United States to India, understanding transit times is crucial for effective planning and customer satisfaction. Various factors can influence how long it takes for shipments to reach their destination. Below, we delve into these factors, provide estimated transit times, and offer insights on how to navigate potential delays.

Factors Influencing Transit Time

-

Shipping Mode: The choice between air freight and sea freight significantly impacts delivery times. Air freight is the fastest option, typically taking a few days, while sea freight can take several weeks due to longer distances and slower transport speeds.

-

Port Congestion: Major ports in both the U.S. and India can experience congestion, especially during peak shipping seasons. Delays caused by port traffic can extend transit times, making it essential to consider this factor when scheduling shipments.

-

Customs Clearance: Customs procedures in both the exporting and importing countries can affect transit times. Shipments may be delayed if documentation is incomplete or if additional inspections are required. It is crucial to ensure that all paperwork is in order, including invoices and KYC documents, to facilitate a smooth clearance process.

-

Routes: The specific shipping route taken can also impact transit times. Direct routes tend to be quicker, while indirect routes involving transshipment may lead to longer delivery times. Additionally, the availability of shipping services on certain routes can vary.

-

Weather Conditions: Adverse weather conditions can disrupt shipping schedules, particularly for air freight. Storms, fog, and other weather-related issues can lead to delays in both departure and arrival times.

Estimated Transit Time Table

The following table provides estimated transit times for shipping from the U.S. to India, considering various shipping methods:

| Origin | Destination | Sea Freight (Days) | Air Freight (Days) |

|---|---|---|---|

| Los Angeles | Mumbai | 25-35 | 5-7 |

| New York | Delhi | 25-35 | 5-7 |

| Chicago | Bangalore | 25-35 | 5-7 |

| San Francisco | Chennai | 25-35 | 5-7 |

| Seattle | Hyderabad | 25-35 | 5-7 |

Context and Explanation

The estimates provided in the table are based on typical port-to-port transit times for standard shipping options. It is important to note that these times do not account for potential delays that can occur at various stages of the shipping process.

For air freight, while the transit time is relatively short, customs clearance can still add a few days to the overall delivery time. Therefore, businesses should allow for additional time when planning shipments, particularly for time-sensitive items.

On the other hand, sea freight, while more economical, involves longer transit times and is subject to various delays, including port congestion and weather disruptions. Importers and exporters should also consider the time it takes to prepare shipments, including packaging and documentation, which can further extend the overall timeline.

In conclusion, effective planning and a comprehensive understanding of transit times and the factors that influence them can help businesses optimize their shipping strategies when sending goods to India from the U.S. By selecting the appropriate shipping mode and preparing all necessary documentation in advance, shippers can mitigate potential delays and ensure a smoother shipping experience.

Navigating Customs Clearance: A Step-by-Step Guide

The Process Explained

Navigating the customs clearance process when shipping from the U.S. to India involves several key steps. Understanding this workflow can help ensure that your shipments arrive smoothly and on time.

-

Preparation Before Shipping: Before you send your package, gather all necessary documentation and information about the items you plan to ship. This includes details like the value of the goods, their description, and the intended use (commercial or personal).

-

Select a Reliable Freight Forwarder: Partnering with a reputable freight forwarder can simplify the customs clearance process. They will guide you through the necessary paperwork, help with logistics, and ensure compliance with customs regulations.

-

Complete Required Documentation: Ensure that you have all essential documents ready, such as the Commercial Invoice, Packing List, and Bill of Lading. Each document plays a critical role in the customs process, as outlined in the next section.

-

Submit KYC Documents: If you are shipping commercial goods, you must provide Know Your Customer (KYC) documents. This includes identity verification documents for the receiver, such as an Aadhar card or GSTIN for companies, which are mandatory for customs clearance in India.

-

Customs Declaration: Your freight forwarder or shipping provider will submit a customs declaration on your behalf. This declaration includes the value of the goods, their classification, and the applicable HS codes.

-

Payment of Duties and Taxes: Once your shipment is declared, customs will calculate the applicable duties and taxes based on the value and classification of the goods. Ensure that you are aware of these costs and make payments promptly to avoid delays.

-

Release and Delivery: After customs approval and payment of any duties, your shipment will be released for delivery. Your freight forwarder or shipping provider will coordinate the final leg of transport to ensure it reaches its destination.

Essential Documentation

Having the right documentation is crucial for smooth customs clearance. Below are the essential documents you will need when shipping to India:

-

Commercial Invoice: This is a critical document that outlines the transaction details between the seller and buyer. It should include the seller’s and buyer’s information, a complete description of the goods, the total value, and payment terms. This invoice is used by customs to assess duties and taxes.

-

Packing List: This document details the contents of the shipment, including item descriptions, quantities, and weights. It helps customs verify the information provided in the commercial invoice and ensures that the items match what is declared.

-

Bill of Lading (BOL): This is a legally binding document issued by the carrier to acknowledge receipt of the goods. It serves as a contract for the transportation of the goods and is essential for tracking and claims purposes.

-

Certificate of Origin: While not always required, this document certifies where the goods were manufactured. It may be necessary for certain products to determine eligibility for preferential tariffs under trade agreements.

-

KYC Documents: As mentioned earlier, these documents are necessary to verify the identity of the receiver. They typically include government-issued identification and, for businesses, the GSTIN.

Duties, Taxes, and HS Codes

Understanding how duties and taxes are calculated is essential for accurate cost estimation when shipping to India.

-

HS Codes: The Harmonized System (HS) code is an internationally standardized numerical method of classifying traded products. Each product is assigned a unique HS code, which customs officials use to determine applicable duties and taxes. Accurate classification is crucial, as misclassification can lead to delays and additional penalties.

-

Duties and Taxes Calculation: Duties are typically calculated based on the CIF (Cost, Insurance, and Freight) value of the goods. The Indian customs authorities apply various rates depending on the product category and its HS code. Additionally, the Integrated Goods and Services Tax (IGST) is applied to most imports, further affecting the total cost.

Common Problems & Solutions

- Incomplete Documentation:

- Problem: Missing or incorrect documentation can delay customs clearance.

-

Solution: Double-check all required documents before shipping. Use a checklist to ensure that everything is complete and accurate.

-

Incorrect HS Code:

- Problem: Misclassifying goods under the wrong HS code can result in higher duties or customs delays.

-

Solution: Research and verify the correct HS code for your products ahead of time. Consult with your freight forwarder or customs broker for assistance.

-

Failure to Provide KYC Documents:

- Problem: Not submitting KYC documents can lead to shipment delays or returns.

-

Solution: Submit all necessary KYC documents before your shipment arrives in India to ensure timely customs clearance.

-

Unforeseen Duties and Taxes:

- Problem: Unexpected costs can arise if duties and taxes are not calculated in advance.

-

Solution: Utilize tools like DHL’s Landed Cost Estimator to get a clear understanding of potential duties and taxes before shipping.

-

Prohibited Items:

- Problem: Shipping prohibited items can lead to confiscation and legal issues.

- Solution: Familiarize yourself with India’s list of prohibited and restricted items before shipping. Consult with your freight forwarder for guidance.

By following this comprehensive guide to customs clearance, you can navigate the complexities of shipping from the U.S. to India more effectively, ensuring a smoother process and timely delivery of your goods.

A Practical Guide to Choosing Your Freight Forwarder

Understanding Your Freight Forwarding Needs

When shipping goods from the U.S. to India, selecting the right freight forwarder is crucial for ensuring timely delivery, cost-effectiveness, and compliance with regulations. A freight forwarder acts as an intermediary between shippers and carriers, facilitating the movement of goods while navigating the complexities of international shipping. Here’s a practical guide to help you choose the right freight forwarder for your shipping needs.

Key Qualities to Look For

- Experience and Expertise:

-

Look for a freight forwarder with extensive experience in shipping to India. Familiarity with the specific regulations and challenges of this route can save you time and money.

-

Strong Network:

-

A well-established network of carriers, customs agents, and local logistics providers in both the U.S. and India is essential. This ensures smoother coordination and potentially better rates.

-

Licensing and Certifications:

-

Ensure that the freight forwarder is licensed and compliant with both U.S. and Indian regulations. Look for certifications such as IATA (International Air Transport Association) or FMC (Federal Maritime Commission) approval.

-

Effective Communication:

-

Choose a forwarder that prioritizes clear communication. They should be responsive and provide regular updates on the status of your shipment. A dedicated account manager can enhance this communication.

-

Technology and Tracking Capabilities:

- A forwarder that utilizes modern technology for tracking shipments and managing logistics can provide you with real-time updates and greater transparency throughout the shipping process.

Sourcing Checklist

To ensure you select the right freight forwarder for your shipments to India, follow this checklist:

- Define Your Shipping Needs:

-

Identify the types of goods you will be shipping, their volume, and any specific requirements (e.g., temperature control, hazardous materials).

-

Research Potential Forwarders:

-

Compile a list of potential freight forwarders. Use online resources, industry recommendations, and customer reviews to gather information.

-

Request Quotes:

-

Reach out to the shortlisted forwarders and request quotes. Ensure that the quotes are detailed and include all associated costs, such as duties, taxes, and handling fees.

-

Ask Questions:

-

Inquire about their experience with shipments to India, their customs clearance processes, and how they handle delays or issues. Ask for specifics regarding their tracking systems and customer support.

-

Check References:

- Request references from previous clients, particularly those who have shipped to India. Contact these references to gauge their satisfaction and experiences with the forwarder.

Red Flags to Watch Out For

While selecting a freight forwarder, be cautious of the following warning signs that may indicate potential issues:

-

Lack of Transparency: If a forwarder is unwilling to provide clear information about their pricing, services, or processes, consider it a red flag.

-

Limited Experience with India: A forwarder with little to no experience in shipping to India may struggle with customs regulations and local logistics challenges.

-

Poor Communication: If you find it difficult to get timely responses or clear answers to your questions during the initial discussions, this could reflect their level of service.

-

Negative Reviews: Check online reviews and testimonials. A pattern of complaints regarding delays, lost shipments, or poor customer service should raise concern.

-

High Upfront Costs: Be wary of freight forwarders that demand significant upfront payments without a clear breakdown of services. This could indicate potential hidden fees.

Conclusion

Choosing the right freight forwarder for shipping from the U.S. to India is a critical decision that can significantly impact your logistics efficiency and overall shipping costs. By focusing on key qualities, following a structured sourcing checklist, and being aware of potential red flags, you can make an informed choice that aligns with your business needs. Remember, a reliable freight forwarder not only helps in shipping your products but also acts as a valuable partner in navigating the complexities of international trade.

Incoterms 2020 Explained for Shippers

Understanding Incoterms for International Shipping

Incoterms, or International Commercial Terms, are standardized trade terms established by the International Chamber of Commerce (ICC) that define the responsibilities of buyers and sellers involved in international shipping. These terms clarify who is responsible for transportation costs, insurance, risk, and customs duties. For shippers, especially those engaged in shipping from the U.S. to India, understanding Incoterms is crucial for budgeting shipping rates and ensuring compliance with international trade regulations.

Key Incoterms Table

| Incoterm | Who Pays for Transport? | Where Risk Transfers? | Best for |

|---|---|---|---|

| EXW | Buyer | At the seller’s premises | Buyers looking for maximum control over shipping |

| FOB | Seller | At the ship’s rail in the port of shipment | Sellers wanting to retain control until the goods are loaded |

| CIF | Seller | When the goods are loaded on the ship | Buyers wanting to minimize risk during sea transport |

| DDP | Seller | At the buyer’s location | Buyers desiring a hassle-free delivery experience |

Detailed Explanation of Incoterms

EXW (Ex Works)

Under the EXW Incoterm, the seller makes the goods available at their premises or another specified location. The buyer is responsible for all transportation costs and risks from that point onward. This term is best suited for buyers who wish to have complete control over the shipping process, including selecting carriers and managing logistics. For instance, if a U.S. manufacturer sells machinery to a company in India under EXW terms, the Indian buyer would need to arrange and pay for all transportation, insurance, and customs clearance from the U.S. facility to their final destination.

FOB (Free on Board)

FOB indicates that the seller is responsible for transportation costs and risk until the goods are loaded onto the vessel at the port of shipment. Once the goods are on board, the risk transfers to the buyer. This term is particularly useful for sellers who want to manage the logistics up to the shipping point while allowing buyers to take over responsibility for the journey across the sea. For example, if a U.S. exporter ships textiles to India under FOB terms, the seller will cover transport to the port and loading, while the Indian buyer assumes risk during the sea voyage.

CIF (Cost, Insurance, and Freight)

CIF means that the seller covers the costs of transport and insurance up to the port of destination. The risk transfers to the buyer once the goods are loaded onto the ship. This term is ideal for buyers who wish to reduce their risk during sea transport but still want to ensure that insurance is in place. For instance, when a U.S. electronics manufacturer ships products to India under CIF terms, they will pay for shipping and insurance until the goods reach the Indian port, after which the buyer assumes all risks.

DDP (Delivered Duty Paid)

DDP is the most seller-favorable Incoterm, as it requires the seller to cover all costs, including shipping, insurance, customs duties, and taxes, until the goods reach the buyer’s specified location. This term is highly advantageous for buyers who prefer a hassle-free experience since they don’t have to deal with customs or additional costs upon arrival. For example, if a U.S. company sells software to a client in India on DDP terms, they would handle all logistics and ensure that the software is delivered directly to the client’s office in India, including all necessary import duties.

Conclusion

In summary, understanding Incoterms is essential for international shippers, importers, and exporters. By selecting the right Incoterm, businesses can effectively manage their shipping costs, risks, and responsibilities when transporting goods from the U.S. to India. As global trade continues to evolve, staying informed about these terms will help ensure smoother transactions and compliance with international shipping regulations.

Risk Management: Identifying and Mitigating Common Shipping Problems

Introduction

In the dynamic world of international shipping, particularly when transporting goods from the United States to India, proactive risk management is vital for businesses. Unexpected challenges can arise at any point in the shipping process, potentially leading to financial losses, delays, and reputational damage. By identifying and mitigating common shipping problems, shippers can enhance their operational efficiency, ensure compliance with regulations, and ultimately improve customer satisfaction. This guide outlines the potential risks associated with shipping to India and offers practical strategies to manage them effectively.

Risk Analysis Table

| Potential Risk | Impact | Mitigation Strategy |

|---|---|---|

| Cargo Damage | Loss of product integrity, increased costs for replacements, and potential legal issues. | Invest in quality packaging materials; conduct regular training for handling personnel; consider using specialized carriers for fragile items. |

| Delays | Increased shipping costs, customer dissatisfaction, and potential loss of business. | Use reliable logistics partners with a strong track record; keep track of seasonal trends and plan shipments accordingly; maintain clear communication with shipping providers. |

| Customs Holds | Delayed deliveries, additional storage costs, and potential fines. | Ensure all documentation is complete and accurate; familiarize yourself with Indian customs regulations; engage a customs broker to facilitate the process. |

| Regulatory Changes | Sudden changes in shipping laws can lead to compliance issues and potential fines. | Stay informed about updates in shipping regulations through industry newsletters and government websites; participate in training sessions or workshops on compliance. |

| Currency Fluctuations | Variations in exchange rates can affect shipping costs and profitability. | Utilize forward contracts to lock in exchange rates; monitor currency trends and adjust pricing strategies accordingly. |

| KYC Documentation Issues | Delays in customs clearance and increased costs due to non-compliance. | Prepare necessary KYC documents in advance, ensuring they are up-to-date; consult with your logistics provider about specific requirements for shipments to India. |

Cargo Insurance Explained

Cargo insurance is an essential component of risk management in international shipping. It protects your investment against a range of potential losses, including damage, theft, and loss during transit. Understanding what cargo insurance covers, its types, and its importance can help businesses safeguard their interests effectively.

What Cargo Insurance Covers

Cargo insurance typically covers a variety of risks associated with shipping, including:

- Damage or Loss: Protection against physical loss or damage to goods while in transit.

- Theft: Coverage for stolen items during transportation.

- Natural Disasters: Protection against losses due to unforeseen events such as floods, storms, or earthquakes.

- Transport Errors: Coverage for mistakes made by carriers or freight forwarders.

Types of Cargo Insurance

-

All-Risk Coverage: This comprehensive policy covers all potential risks unless specifically excluded. It is ideal for businesses looking for maximum protection.

-

Named Perils Coverage: This policy only covers losses due to specific perils listed in the policy, such as fire, theft, or collision. It is typically less expensive but offers limited protection.

-

Contingency Insurance: This type of insurance covers losses that occur when the primary insurance is inadequate or unavailable, acting as a supplementary policy.

Why Cargo Insurance is Essential

Investing in cargo insurance is critical for several reasons:

- Financial Protection: It mitigates the financial impact of unexpected losses, ensuring that businesses can recover costs and continue operations without significant disruption.

- Peace of Mind: Knowing that your goods are insured allows for greater confidence in the shipping process, enabling businesses to focus on other operational aspects.

- Competitive Advantage: Offering insured shipping options can enhance customer trust and satisfaction, particularly for high-value shipments.

In conclusion, proactive risk management in shipping to India from the U.S. involves identifying potential risks, implementing effective mitigation strategies, and considering cargo insurance to protect your investments. By taking these steps, businesses can navigate the complexities of international shipping with greater ease, ensuring compliance and customer satisfaction along the way.

Frequently Asked Questions (FAQs) for shipping rates to india from us

1. What factors influence shipping rates from the U.S. to India?

Shipping rates to India are influenced by several key factors including the weight and dimensions of the package, the shipping service selected (express vs. standard), the destination within India, and any additional services required such as insurance or special handling. Customs duties and taxes may also impact overall costs.

2. How can I calculate shipping costs to India?

You can calculate shipping costs to India by using online quoting tools provided by carriers like DHL, FedEx, and USPS. Simply enter the shipment details, including weight, dimensions, and destination, to receive an estimated shipping rate. These tools also allow you to explore different delivery speeds and services.

3. What is the difference between AWB and BOL?

An AWB (Air Waybill) is a document used by air carriers that serves as a receipt for goods and a contract for transport. It is specific to air shipments. A BOL (Bill of Lading), on the other hand, is a broader shipping document used in various transport modes (land, sea, air) that serves a similar purpose but can also represent ownership of the goods.

4. Are there any customs duties or taxes for shipping to India?

Yes, all items imported into India are subject to customs duties and taxes. The amount varies based on the type of item, its declared value, and whether it is for commercial or personal use. It’s advisable to use tools like DHL’s Landed Cost Estimator to get an upfront estimate of these costs.

5. What documents are required for shipping to India?

Shipping to India typically requires a commercial invoice, packing list, and any necessary KYC (Know Your Customer) documents for customs clearance. KYC documents may include proof of identity and address for the recipient, such as an Aadhar card or passport, especially for commercial shipments.

6. How is chargeable weight calculated?

Chargeable weight is calculated based on the greater of the actual weight or the dimensional weight of the package. Dimensional weight is determined by measuring the length, width, and height of the package and applying a specific formula set by the carrier. This ensures that shipping rates reflect the space a package occupies in transit.

7. What is the typical delivery time for shipments to India?

Delivery times vary based on the shipping service selected. Express services can deliver packages within 1-3 business days, while standard shipping options may take anywhere from 5-10 business days. Factors such as customs clearance and local delivery conditions can also affect delivery times.

8. Can I track my shipment to India?

Yes, most carriers provide tracking services that allow you to monitor your shipment in real-time. You can enter your tracking number on the carrier’s website (e.g., DHL, FedEx, USPS) to get updates on the status and location of your package.

9. What items are prohibited from being shipped to India?

India has strict regulations regarding imports, and certain items are prohibited, including wild animal products, certain animal-origin products, telecommunication devices, and more. It is essential to check the comprehensive list of prohibited items provided by the Indian government before shipping.

10. How can I expedite customs clearance for my shipment?

To expedite customs clearance, ensure that all required documents are complete and submitted in advance, including KYC documents and a detailed invoice with correct HS codes and value declarations. Using express shipping services can also help facilitate faster customs processing.

Conclusion: Key Takeaways for Successful Shipping

Effective Strategies for Shipping to India

Navigating the complexities of shipping from the U.S. to India can be daunting, but with the right strategies, businesses can ensure a smooth and cost-effective process. Here are the essential takeaways for successful shipping:

1. Thorough Planning is Crucial

Before initiating any shipment, it’s vital to thoroughly plan your logistics. This includes understanding the specific requirements for customs clearance in India, such as necessary documentation like KYC (Know Your Customer) forms, invoices with accurate descriptions, and the correct HS codes for your goods. Proper planning not only speeds up delivery times but also minimizes the risk of unexpected delays or additional charges.

2. Choose the Right Shipping Partner

Selecting a reliable shipping partner can significantly impact your shipping experience. Global logistics providers such as FedEx, DHL, and USPS offer tailored solutions that cater to various needs, from express deliveries to cost-effective options for larger shipments. Evaluate their services based on delivery speed, reliability, and customer support to find the best fit for your business.

3. Understand the Cost Structure

Shipping costs to India can vary greatly based on several factors including package weight, size, delivery speed, and additional services. Utilize quoting tools provided by logistics companies to get a comprehensive overview of potential costs. Additionally, be aware of duties and taxes that apply to your shipments; understanding these can help you avoid surprises at customs.

4. Stay Informed on Regulations

Regulatory compliance is non-negotiable in international shipping. Familiarize yourself with India’s import restrictions and requirements to prevent your goods from being delayed or rejected. Regularly consult official sources or your shipping partner for updates on regulations and customs procedures.

Take Action Now

By implementing these strategies, you can enhance your shipping operations to India and ensure timely deliveries. Whether you are an importer or exporter, taking the time to plan, choose the right partners, and understand costs will lead to a more efficient shipping process. Don’t hesitate to reach out to logistics experts to refine your shipping strategy and take your business to new heights in the Indian market. Start your shipping journey today!

Important Disclaimer

⚠️ Important Disclaimer

The information in this guide is for educational purposes only and does not constitute professional logistics advice. Rates, times, and regulations change frequently. Always consult with a qualified freight forwarder for your specific needs.