How to Ship ‘Shipping Cost From 10607 To 77059’: Costs, Times & Pro…

Your Complete Guide to shipping cost from 10607 to 77059

Shipping goods across the United States can be a daunting task for many businesses, especially when navigating the complexities of costs and logistics. Whether you are an international shipper, an importer, or an exporter, understanding the intricacies of shipping from ZIP code 10607 (White Plains, New York) to ZIP code 77059 (Houston, Texas) is essential for ensuring efficient operations and maintaining profitability. One of the significant challenges businesses face is the unpredictable nature of shipping costs, which can vary widely based on numerous factors including package weight, dimensions, shipping method, and even the time of year.

In this guide, we will delve into several key areas that impact shipping costs from 10607 to 77059. First, we will explore the various shipping methods available, including ground, air, and freight options. Each method has its own advantages and disadvantages, and understanding these can help you make informed decisions that align with your business needs.

Next, we will provide an in-depth analysis of the costs associated with each shipping method. You will learn how to calculate shipping costs effectively, taking into account not only the base rates but also additional fees such as fuel surcharges, insurance, and handling fees. This knowledge is crucial for budgeting and pricing your products accurately.

Transit times are another critical factor in the shipping process. We will outline the expected delivery times for different shipping methods, helping you to set realistic expectations with your customers and plan your inventory management accordingly.

Customs considerations are also a vital part of the shipping equation, particularly for international shipments. We will guide you through the necessary documentation and compliance requirements to ensure your shipments are not delayed at customs.

Lastly, we will address the risks involved in shipping, including potential damage, loss, or delays. Understanding these risks will enable you to implement strategies to mitigate them, protecting your assets and maintaining customer satisfaction.

By the end of this comprehensive guide, you will be equipped with expert knowledge that empowers you to navigate the complexities of shipping costs from 10607 to 77059 efficiently. Whether you are shipping locally or internationally, this guide will serve as your essential resource for optimizing your shipping strategy and enhancing your business operations.

Table of Contents

- Your Complete Guide to shipping cost from 10607 to 77059

- Understanding Your Shipping Options: A Detailed Comparison

- Deconstructing the Cost: A Full Pricing Breakdown

- Transit Time Analysis: How Long Will It Take?

- Navigating Customs Clearance: A Step-by-Step Guide

- A Practical Guide to Choosing Your Freight Forwarder

- Incoterms 2020 Explained for Shippers

- Risk Management: Identifying and Mitigating Common Shipping Problems

- Frequently Asked Questions (FAQs) for shipping cost from 10607 to 77059

- Conclusion: Key Takeaways for Successful Shipping

- Important Disclaimer

Understanding Your Shipping Options: A Detailed Comparison

Overview of Shipping Methods

When shipping goods from ZIP code 10607 (New York) to 77059 (Texas), selecting the right transportation method is crucial for optimizing cost, speed, and overall efficiency. This section provides an in-depth comparison of various shipping methods, detailing their advantages and disadvantages, allowing shippers to make informed decisions based on their specific needs.

| Shipping Method | Best For | Speed | Cost Level | Key Advantages | Key Disadvantages |

|---|---|---|---|---|---|

| Sea FCL | Large volumes | 20-40 days | Moderate | Economical for bulk shipments; high capacity | Slow transit times; port handling delays |

| Sea LCL | Smaller volumes | 20-40 days | Moderate-High | Cost-effective for smaller loads; shared costs | Longer delivery times due to consolidation |

| Air | Time-sensitive goods | 1-5 days | High | Fastest delivery; excellent tracking | Expensive; weight restrictions |

| Rail | Heavy, bulk goods | 3-10 days | Moderate | Eco-friendly; cost-effective for long distances | Limited routes; slower than air |

| Express | Urgent shipments | 1-3 days | Very High | Fast and reliable; door-to-door service | Very costly; size and weight limitations |

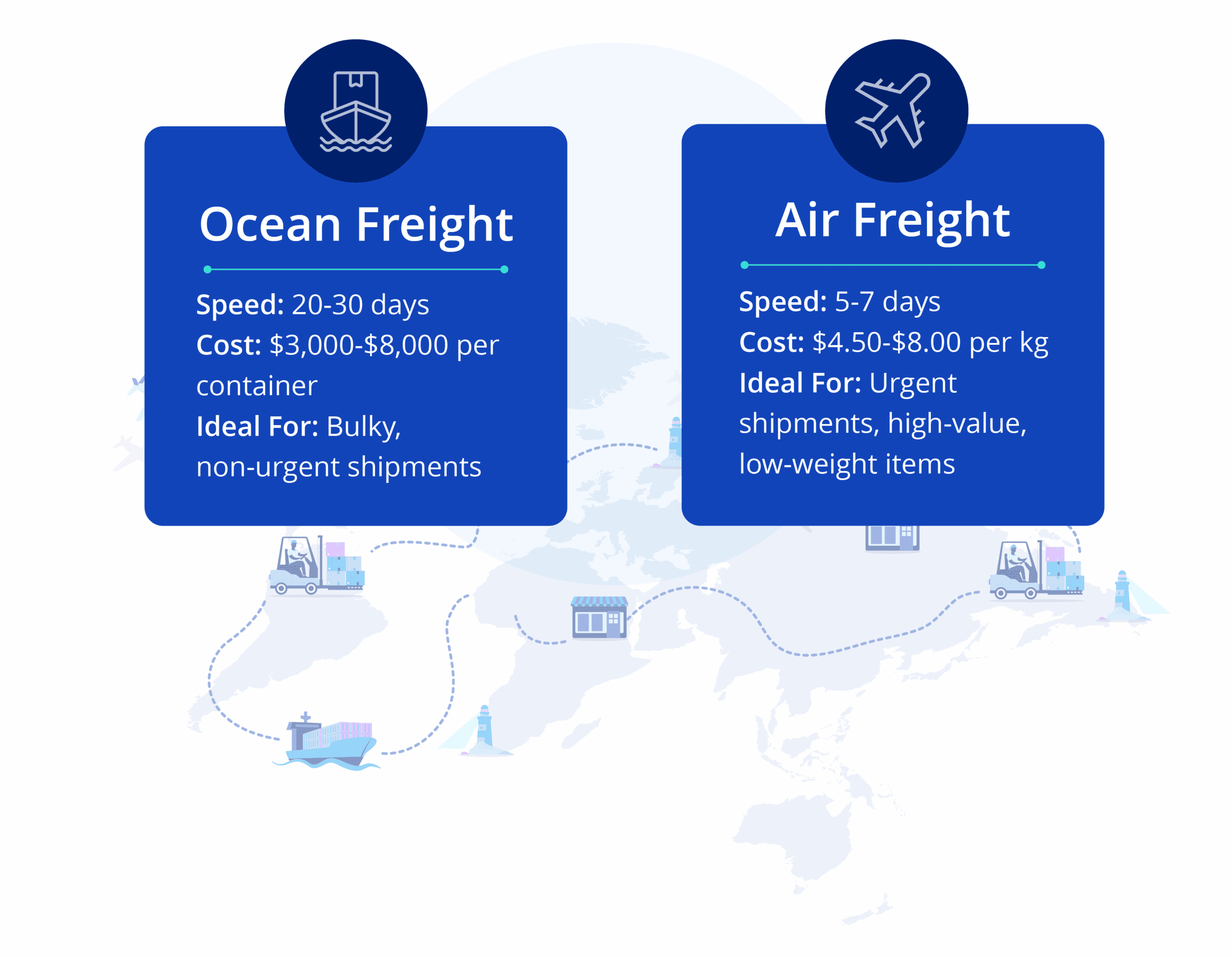

Sea Freight

Full Container Load (FCL)

What It Is: Shipping via a full container load means that an entire container is dedicated to a single shipper’s goods.

When to Use: FCL is ideal for businesses with large volumes of goods to ship, making it cost-effective.

Pros:

– Economical for bulk shipments.

– Less risk of damage since the shipment is not shared with others.

– Simplified customs clearance.

Cons:

– Requires a larger upfront investment.

– Longer transit times compared to air freight.

Less than Container Load (LCL)

What It Is: LCL allows shippers to share container space with other businesses, making it suitable for smaller shipments.

When to Use: Use LCL when your shipment does not fill a full container.

Pros:

– Cost-effective for smaller loads.

– Flexibility in shipping frequency.

Cons:

– Potential delays due to consolidation.

– Higher risk of damage as goods are handled more frequently.

Air Freight

What It Is: Air freight involves shipping goods via commercial or cargo planes.

When to Use: This method is best for high-value or time-sensitive shipments.

Pros:

– The fastest shipping option available.

– Excellent tracking capabilities.

– Reliable delivery schedules.

Cons:

– Higher costs compared to sea freight.

– Limited capacity for heavy or oversized items.

Rail Freight

What It Is: Rail freight is the transportation of goods using trains.

When to Use: It is suitable for heavy and bulk shipments, especially over long distances.

Pros:

– Cost-effective for large volumes.

– More environmentally friendly than road transport.

Cons:

– Limited availability based on geographic location.

– Slower than air transport, but faster than sea freight.

Express Shipping

What It Is: Express shipping provides expedited delivery services for urgent shipments.

When to Use: Ideal for critical shipments that require immediate delivery.

Pros:

– Quick delivery, often within 24-48 hours.

– Comprehensive tracking and reliable service.

Cons:

– Extremely high costs.

– Restrictions on package size and weight.

Special Considerations

Multimodal Transport

Multimodal transport utilizes more than one mode of transportation to move goods, such as combining rail and truck services. This approach can optimize costs and transit times by leveraging the strengths of each transport mode. Businesses should consider this option when dealing with complex supply chains or when specific routes are limited.

Specialized Options

- Roll-on/Roll-off (RoRo): This method is used for transporting wheeled cargo (like vehicles) directly onto the vessel. It is efficient and cost-effective for vehicle shipping but not suitable for general cargo.

- Break Bulk: This refers to cargo that must be loaded individually, and not in containers. It’s typically used for oversized items that cannot fit in standard containers. While it allows for flexibility, it can increase handling costs and the risk of damage.

Conclusion

In summary, selecting the right shipping method from 10607 to 77059 involves assessing the nature of the goods, budget constraints, and time sensitivity. While sea freight (both FCL and LCL) offers economical options for bulk shipments, air freight is unmatched for speed. Rail freight provides a balance between cost and environmental considerations, while express shipping is reserved for urgent needs. Understanding these options will enable businesses to optimize their logistics strategies effectively.

Deconstructing the Cost: A Full Pricing Breakdown

Understanding Shipping Costs: A Comprehensive Breakdown

When shipping goods from ZIP code 10607 (New York) to 77059 (Houston, Texas), several costs come into play. Shipping costs can vary significantly based on a multitude of factors, including the mode of transport, the nature of the goods, and the specific services required. Below, we break down the key components of shipping costs to provide clarity for international shippers, importers, exporters, and business owners.

Main Cost Components

Shipping costs can be broadly categorized into three primary components:

- Main Freight

- Origin Charges

- Destination Charges

Main Freight

Main freight is the primary cost associated with transporting goods from one location to another. This cost is influenced by various factors, including:

- Mode of Transport: Shipping via sea freight is generally cheaper than air freight, especially for larger volumes. For instance, a 20ft shipping container will have a different rate than a 40ft container or less-than-container load (LCL).

- Distance: The distance between the origin and destination plays a critical role. Longer distances typically incur higher freight charges.

- Type of Cargo: Special cargo, such as hazardous materials or perishables, may require specialized handling and incur additional costs.

- Weight and Volume: Shipping costs are often calculated based on the weight or volumetric weight (dimensional weight) of the shipment, whichever is greater.

Origin Charges

Origin charges are fees incurred at the shipping origin before the goods leave the country. These may include:

- Packing Costs: The cost of packing materials and labor to prepare goods for shipment.

- Documentation Fees: Charges for preparing necessary shipping documents, including bills of lading and customs paperwork.

- Handling Fees: Charges for loading goods onto the transport vehicle.

- Customs Clearance: If applicable, costs associated with clearing goods through customs at the point of origin.

Destination Charges

Destination charges are fees incurred upon arrival at the destination. These charges can include:

- Unloading Fees: Costs for unloading goods from the transport vehicle at the destination.

- Customs Duties and Taxes: Import duties and taxes levied by the government at the destination country.

- Delivery Charges: Fees for transporting goods from the port or airport to the final destination, which can vary based on distance and the nature of the cargo.

- Storage Fees: If goods are held at the destination for an extended period before delivery, storage fees may apply.

Detailed Cost Factor Analysis

Now, let’s dive deeper into each cost component to understand what influences the price.

Main Freight

The main freight is often the most significant portion of the total shipping cost. Pricing can vary based on:

- Carrier Selection: Different freight carriers offer varying rates, and businesses can often negotiate pricing based on volume.

- Seasonality: Shipping rates can fluctuate based on peak seasons, such as holidays or harvest seasons, when demand for freight services increases.

- Fuel Prices: Changes in fuel prices can directly impact freight costs, particularly for trucking and air freight.

Origin Charges

Origin charges can be influenced by:

- Location: Urban areas may have higher handling and packing fees compared to rural areas due to higher labor costs.

- Service Level: Choosing expedited packing or handling services will increase origin charges.

- Regulatory Requirements: Certain products may require additional documentation or handling fees at the origin.

Destination Charges

Destination charges can vary based on:

- Local Regulations: Each destination may have unique customs regulations affecting clearance fees.

- Delivery Method: Costs can vary significantly depending on whether the goods are delivered to a business or residential address.

- Distance from Port: The distance from the port to the final delivery location influences delivery charges, especially in large metropolitan areas.

Example Pricing Table

To illustrate shipping costs more concretely, below is a sample pricing table for sea freight and air freight. Please note that these are estimated costs and can vary based on the factors discussed above.

| Shipping Method | 20ft Container | 40ft Container | Less Than Container Load (LCL) | Air Freight (per kg) |

|---|---|---|---|---|

| Sea Freight | $1,200 | $2,300 | $250 (approx. for 1m³) | N/A |

| Air Freight | N/A | N/A | N/A | $5.50 |

Disclaimer: The above prices are estimates and can vary based on specific shipping conditions, carrier, and other factors.

How to Reduce Shipping Costs

Reducing shipping costs can have a significant impact on a business’s bottom line. Here are some actionable tips:

- Consolidate Shipments: Combine smaller shipments into larger ones to take advantage of economies of scale and lower rates.

- Negotiate Rates: Develop relationships with freight carriers and negotiate better rates based on shipping volume and frequency.

- Choose the Right Mode of Transport: Assess whether air freight is necessary for time-sensitive shipments or if sea freight would suffice for cost savings.

- Optimize Packaging: Use efficient packaging to minimize weight and volume, which can lower freight costs.

- Plan Ahead: Avoid last-minute shipments that often come with higher rates by planning shipments in advance.

- Utilize Freight Forwarders: Work with freight forwarders who can leverage their networks to secure better rates and streamline logistics.

- Stay Informed on Regulations: Understanding customs regulations can help avoid unexpected fees and ensure compliance.

By understanding the various components that contribute to shipping costs and implementing strategies to reduce these expenses, businesses can enhance their logistics efficiency and improve their overall profitability.

Transit Time Analysis: How Long Will It Take?

Understanding Transit Times for Shipping from 10607 to 77059

When shipping goods from the ZIP code 10607 (White Plains, New York) to 77059 (Houston, Texas), several factors can influence the transit time. Understanding these variables is crucial for international shippers, importers, exporters, and business owners to effectively plan their logistics and meet customer expectations.

Factors Influencing Transit Time

-

Shipping Mode: The choice between air freight and sea freight significantly affects transit times. Air freight is generally faster, with delivery times ranging from one to three days, depending on the service chosen. In contrast, sea freight can take anywhere from five to 20 days, primarily due to the longer travel distances and additional handling times at ports.

-

Port Congestion: Congestion at ports can create delays in both loading and unloading cargo. This is particularly relevant in busy ports like those in New York and Texas, where heavy traffic can lead to bottlenecks. Seasonal shipping spikes, such as during holidays or major sales events, can exacerbate these delays.

-

Customs Clearance: Customs procedures can vary in efficiency, impacting transit times. Shipments may be held for inspection or documentation checks, leading to unpredictable delays. It is advisable to ensure that all paperwork is in order and to work with customs brokers to expedite the process.

-

Shipping Routes: The chosen shipping route can also affect delivery times. Direct routes are faster, while indirect routes may involve multiple stops and transshipments, significantly increasing the overall transit time.

-

Weather Conditions: Adverse weather can disrupt transportation schedules. For instance, storms or severe weather conditions may delay shipments, particularly for air freight. It is essential to stay informed about weather forecasts along the transit route.

Estimated Transit Time Table

Below is an estimated transit time table for shipping from 10607 (White Plains, NY) to 77059 (Houston, TX), considering various shipping modes:

| Origin | Destination | Sea Freight (Days) | Air Freight (Days) |

|---|---|---|---|

| 10607 | 77059 | 5 – 10 | 1 – 3 |

Context and Explanation

The estimates provided in the table represent typical transit times for port-to-port shipments. It’s important to note that these figures can vary based on the factors discussed above. For example, while air freight offers a quicker alternative, it may be subject to additional costs and limitations on cargo size and weight.

When planning shipments, businesses should consider potential delays and build in buffer times. For instance, if a shipment is time-sensitive, opting for air freight may be prudent despite the higher costs. Conversely, for less urgent shipments, sea freight can be a cost-effective solution, but businesses should account for the potential for longer transit times due to port congestion or customs delays.

In summary, effective logistics planning requires a comprehensive understanding of the various elements that influence transit times. By considering shipping mode, port conditions, customs processes, routes, and weather, shippers can better manage their expectations and ensure timely delivery of goods. Whether you’re an international shipper from Australia, Germany, or Nigeria, understanding these dynamics will enhance your shipping strategy and improve overall efficiency.

Navigating Customs Clearance: A Step-by-Step Guide

The Process Explained

Navigating customs clearance can be a complex process, especially for international shippers and businesses. Here’s a streamlined workflow to guide you through the customs clearance process when shipping from ZIP code 10607 to 77059.

-

Preparation of Shipping Documents

Before initiating the shipment, gather all necessary documents. This includes the commercial invoice, packing list, and any specific permits or licenses required based on the nature of your goods. -

Select a Customs Broker

Engaging a licensed customs broker can simplify the process. A broker will help ensure that your shipment complies with all regulations, submit necessary documentation, and communicate with customs authorities on your behalf. -

Submit Required Documentation

Your customs broker will submit all required documents to the relevant customs authority. This typically includes a commercial invoice, packing list, and any additional documents pertinent to the shipment. -

Customs Review and Inspection

Customs will review the submitted documents and may select your shipment for inspection. This step is crucial for confirming that the contents match the provided documentation and comply with regulations. -

Duties and Taxes Assessment

Once customs has reviewed the shipment, they will assess any applicable duties and taxes based on the declared value of the goods and their classification under the Harmonized System (HS) codes. -

Payment of Duties and Taxes

After assessment, you must pay the calculated duties and taxes. This payment is necessary for the release of your goods from customs. -

Release of Shipment

Once all documentation is in order and duties are paid, customs will release your shipment. Your goods can then proceed to their final destination in ZIP code 77059.

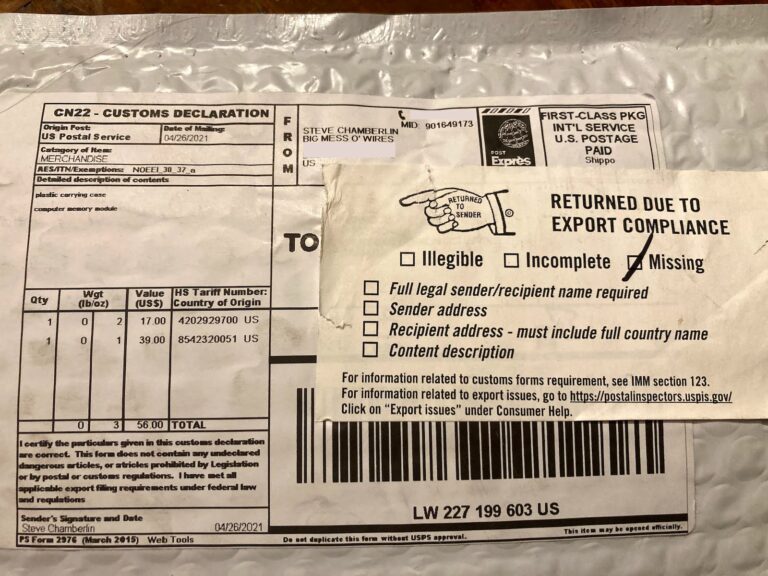

Essential Documentation

When shipping internationally, several key documents are required to facilitate customs clearance:

-

Commercial Invoice

This is a crucial document that details the transaction between the seller and buyer. It includes information such as the description of goods, quantity, value, and terms of sale. The commercial invoice serves as the primary document for customs authorities to assess duties and taxes. -

Packing List

A packing list complements the commercial invoice by detailing how the goods are packed. It includes information about the contents of each package, dimensions, and weight. This document helps customs officials verify the shipment during inspection. -

Bill of Lading (BOL)

The BOL is a contract between the shipper and carrier that outlines the terms of transportation. It serves as a receipt for the goods and can be used in legal contexts. The BOL should accurately reflect the details of the shipment to avoid delays. -

Import/Export Licenses

Depending on the nature of the goods being shipped, special permits or licenses may be required. Research and obtain any necessary documentation before shipping. -

Customs Declaration

This document provides customs with essential information about the shipment, including the nature of the goods, their value, and their origin. It is typically completed by the customs broker on your behalf.

Duties, Taxes, and HS Codes

Harmonized System (HS) Codes

HS codes are standardized numerical codes used globally to classify traded products. They help customs authorities identify the nature of the goods being shipped, which is crucial for determining the applicable duties and taxes. Each product is assigned a unique HS code that corresponds to its classification.

Duties and Taxes Calculation

Duties and taxes are generally calculated based on the value of the goods declared on the commercial invoice, along with their HS classification. The duty rate varies depending on the product type and its country of origin. To estimate costs:

- Determine the Customs Value: This is typically the invoice value of the goods plus shipping costs.

- Apply the HS Code: Use the HS code to find the applicable duty rate.

- Calculate Duties and Taxes: Multiply the customs value by the duty rate to determine the total duties owed.

Common Problems & Solutions

-

Incomplete Documentation

Problem: Missing or inaccurate documentation can lead to shipment delays.

Solution: Double-check all required documents before submission. Work with a customs broker to ensure everything is in order. -

Incorrect HS Code Classification

Problem: Misclassifying goods under the wrong HS code can result in incorrect duty assessments and penalties.

Solution: Conduct thorough research or consult with a customs expert to ensure proper classification of goods. -

Unexpected Duties and Taxes

Problem: Unexpected fees can arise if the value of goods is underestimated.

Solution: Be transparent about the value of your goods and consult with your broker about potential duties and taxes based on accurate assessments. -

Customs Inspection Delays

Problem: Shipments may be delayed if selected for inspection, especially if documentation is lacking.

Solution: Prepare for inspections by ensuring all documentation is comprehensive and correct. Being proactive can speed up the process. -

Non-Compliance with Regulations

Problem: Failing to comply with specific import/export regulations can lead to fines or confiscation of goods.

Solution: Stay informed about the regulations governing your goods in both the origin and destination countries. Utilize the expertise of a customs broker to navigate complex regulations.

By following this step-by-step guide and being diligent in your documentation and compliance efforts, you can successfully navigate the customs clearance process when shipping from ZIP code 10607 to 77059.

A Practical Guide to Choosing Your Freight Forwarder

Understanding the Importance of a Freight Forwarder

When shipping goods internationally, particularly from ZIP code 10607 to 77059, selecting the right freight forwarder is crucial for ensuring a smooth and cost-effective shipping process. A freight forwarder acts as an intermediary between you and various transportation services, helping to facilitate the logistics of moving your cargo. The right partner can save you time, reduce costs, and enhance your overall shipping experience.

Key Qualities to Look for in a Freight Forwarder

- Experience:

-

Look for a freight forwarder with a proven track record in handling shipments similar to yours. Experience in the specific regions you are shipping to and from, such as Australia, Germany, or Nigeria, is invaluable.

-

Network:

-

A robust network of carriers and agents can significantly influence your shipping costs and service quality. Ensure your freight forwarder has established relationships with reputable shipping lines, airlines, and logistics providers.

-

Licensing and Certifications:

-

Verify that the forwarder holds the necessary licenses and certifications, such as those required by the Federal Maritime Commission (FMC) in the U.S. or equivalent authorities in other countries. This ensures compliance with regulations and promotes reliability.

-

Communication:

-

Effective communication is essential throughout the shipping process. Your freight forwarder should be proactive in providing updates and addressing any concerns promptly. Look for a partner who is accessible and responsive.

-

Technology and Tracking Capabilities:

- In today’s digital age, a forwarder that utilizes modern technology for tracking shipments and managing logistics can provide better visibility and efficiency in your operations.

Sourcing Checklist: Steps to Choose Your Freight Forwarder

- Define Your Needs:

-

Clearly outline what you need from a freight forwarder. Consider factors like shipment size, frequency, destination, and specific services (e.g., customs brokerage, warehousing).

-

Research Potential Forwarders:

-

Utilize online resources, industry directories, and recommendations from peers to compile a list of potential freight forwarders. Pay attention to their specialization and market reputation.

-

Request Quotes:

-

Contact shortlisted forwarders to request detailed quotes. Ensure they include all potential costs—such as shipping, handling, insurance, and customs fees—to allow for accurate comparisons.

-

Ask Questions:

-

Prepare a list of questions to gauge their expertise and service quality. Inquire about their experience with your type of cargo, handling procedures, and how they manage unforeseen issues.

-

Check References:

- Request references from their current or past clients. Contact these references to gain insights into their reliability, service quality, and overall satisfaction.

Red Flags to Watch Out For

- Lack of Transparency:

-

If a freight forwarder is unwilling to provide detailed information about their pricing structure or shipping processes, this can be a warning sign. Transparency is crucial for building trust.

-

Poor Communication:

-

If your inquiries go unanswered or you receive vague responses, this could indicate a lack of professionalism or reliability. A good freight forwarder should prioritize clear and timely communication.

-

No Established Network:

-

Beware of forwarders who cannot demonstrate a well-established network of carriers and agents. This may hinder their ability to provide competitive rates and reliable service.

-

Negative Reviews or Complaints:

-

Research online reviews and industry feedback. A pattern of negative reviews or unresolved complaints can be a significant red flag.

-

Inconsistent or Unprofessional Behavior:

- Trust your instincts; if the freight forwarder displays erratic behavior, fails to meet deadlines, or seems unprofessional, consider looking for alternatives.

Conclusion

Choosing the right freight forwarder is a pivotal decision that can impact your shipping efficiency and costs when moving goods from 10607 to 77059. By focusing on essential qualities, following a systematic sourcing checklist, and being vigilant for red flags, you can find a reliable partner that meets your business needs. This strategic choice not only enhances your shipping operations but also contributes to the overall success of your international trade endeavors.

Incoterms 2020 Explained for Shippers

Understanding Incoterms

Incoterms, or International Commercial Terms, are a set of globally recognized rules that define the responsibilities of buyers and sellers in international trade. Established by the International Chamber of Commerce (ICC), these terms help clarify the costs, risks, and logistics involved in shipping goods across borders. By using Incoterms, shippers can avoid misunderstandings and disputes, ensuring smoother transactions and better management of shipping costs.

Key Incoterms Table

| Incoterm | Who Pays for Transport? | Where Risk Transfers? | Best for |

|---|---|---|---|

| EXW (Ex Works) | Buyer | At the seller’s premises | Buyers with strong logistics capabilities |

| FOB (Free on Board) | Seller | When the goods are loaded onto the vessel | Buyers who prefer to control the shipping process |

| CIF (Cost, Insurance, and Freight) | Seller | When the goods are on board the vessel | Buyers looking for a comprehensive shipping solution |

| DDP (Delivered Duty Paid) | Seller | At the buyer’s premises | Buyers wanting minimal responsibility for shipping |

Detailed Explanation of Common Incoterms

EXW (Ex Works)

Under the EXW term, the seller makes the goods available at their premises or another named place (such as a factory or warehouse). The buyer is responsible for all transportation costs and risks from that point forward. This term is advantageous for buyers with robust logistics capabilities, as they can manage the shipping process from the seller’s location. For example, if a company in Nigeria purchases machinery from a manufacturer in Australia under EXW terms, they would need to arrange and pay for all transportation, including export clearance, shipping, and delivery to their facility in Nigeria.

FOB (Free on Board)

FOB indicates that the seller bears all costs and risks up to the point where the goods are loaded onto the shipping vessel. Once the goods are on board, the responsibility shifts to the buyer. This term is especially useful for buyers who want to control the shipping process. For instance, a German company importing electronics from China may prefer FOB terms, as it allows them to select their freight forwarder while ensuring that the seller handles costs until the cargo is loaded.

CIF (Cost, Insurance, and Freight)

CIF requires the seller to pay for the cost of goods, insurance, and freight necessary to bring the goods to the port of destination. The risk transfers to the buyer once the goods are loaded onto the vessel. This term is ideal for buyers looking for a comprehensive shipping solution, as it simplifies logistics. For example, an importer in Australia purchasing textiles from India might opt for CIF terms, knowing that the seller will take care of insurance and freight costs until the goods reach the Australian port.

DDP (Delivered Duty Paid)

DDP represents the maximum obligation for the seller, who must cover all costs and risks associated with delivering the goods to the buyer’s specified location, including import duties and taxes. This term is beneficial for buyers who want minimal responsibility for shipping, as the seller takes care of everything. For instance, a business in Nigeria ordering equipment from Germany under DDP terms would have the seller handle all logistics, including customs clearance and delivery to their facility, allowing the buyer to focus on their operations without worrying about shipping intricacies.

Conclusion

Understanding Incoterms is essential for international shippers, importers, and exporters, particularly when managing shipping costs that can vary significantly between different terms. By selecting the appropriate Incoterm for their transactions, businesses can streamline logistics, mitigate risks, and ensure that all parties are clear on their responsibilities. Whether you are shipping from a ZIP code in the United States to a destination in Nigeria or Germany, knowing how to navigate these terms can lead to more efficient and cost-effective shipping solutions.

Risk Management: Identifying and Mitigating Common Shipping Problems

Introduction

In the world of international shipping, proactive risk management is not just a good practice; it is essential for safeguarding your investments and ensuring smooth operations. Shipping between different locations, such as from ZIP code 10607 (New York) to 77059 (Texas), presents unique challenges that can impact delivery timelines and costs. By identifying potential risks and implementing mitigation strategies, businesses can minimize disruptions, control expenses, and maintain customer satisfaction. This guide will provide a detailed risk analysis and practical strategies to navigate common shipping problems effectively.

Risk Analysis Table

| Potential Risk | Impact | Mitigation Strategy |

|---|---|---|

| Cargo Damage | Loss of goods, financial losses, delays | Invest in quality packaging materials, employ experienced handlers, and conduct regular inspections. Consider using tracking technology to monitor conditions during transit. |

| Delays | Increased costs, customer dissatisfaction | Choose reliable carriers with a proven track record, plan for potential delays by allowing extra time in shipping schedules, and stay informed about weather conditions and traffic situations. |

| Customs Holds | Increased shipping time, potential fines | Ensure all documentation is accurate and complete, work with customs brokers to navigate regulations, and familiarize yourself with import/export restrictions for both the origin and destination countries. |

| Miscommunication | Incorrect shipment details, lost packages | Maintain clear communication with carriers, use standardized documentation, and implement a centralized system for tracking shipments and updates. Regularly train staff on best practices for communication. |

| Regulatory Compliance | Legal penalties, shipment delays | Stay updated on the latest shipping regulations, ensure compliance with local and international laws, and establish relationships with regulatory agencies. Consult legal experts if necessary. |

Cargo Insurance Explained

Cargo insurance is a critical component of risk management in shipping. It serves to protect your goods against loss or damage during transit, offering peace of mind and financial security. Understanding the different types of cargo insurance and their coverage is essential for any business engaged in international shipping.

What Cargo Insurance Covers

Cargo insurance typically covers the following scenarios:

- Theft: Protection against loss due to theft during transit.

- Damage: Coverage for physical damage to the cargo caused by accidents, weather conditions, or mishandling.

- Loss: Compensation for goods lost in transit, whether due to accidents, sinking, or other unforeseen events.

- General Average: In maritime shipping, this protects shippers from losses incurred when a ship’s cargo is sacrificed for the safety of the vessel.

Types of Cargo Insurance

-

All-Risk Insurance: This type of policy covers a wide range of risks, including theft, damage, and loss, unless explicitly excluded. It is the most comprehensive option but may come at a higher premium.

-

Named Perils Insurance: This policy covers only specific risks that are listed in the agreement, such as fire, collision, or sinking. It is generally less expensive than all-risk insurance but may leave gaps in coverage.

-

Specific Coverage: Tailored for particular types of goods or shipping methods, these policies are designed to address unique risks associated with certain cargo.

Why Cargo Insurance is Essential

Investing in cargo insurance is crucial for several reasons:

- Financial Protection: It mitigates the risk of financial loss due to unforeseen events, allowing businesses to maintain their bottom line even in adverse situations.

- Peace of Mind: Knowing that your cargo is insured can reduce stress and help you focus on other aspects of your business.

- Customer Confidence: Having cargo insurance enhances your credibility with customers, as it demonstrates a commitment to safeguarding their investments.

Conclusion

Proactive risk management in shipping is vital for minimizing disruptions and controlling costs. By understanding potential risks and implementing effective mitigation strategies, businesses can navigate the complexities of international shipping more confidently. Additionally, investing in cargo insurance provides essential protection against loss or damage, ensuring that your shipments remain secure throughout their journey. By adopting these practices, shippers, importers, and exporters can enhance their operational efficiency and maintain strong customer relationships.

Frequently Asked Questions (FAQs) for shipping cost from 10607 to 77059

1. What factors influence the shipping cost from 10607 to 77059?

Shipping costs are influenced by several factors, including the weight and dimensions of the package, the shipping method selected (e.g., ground, air), distance, and delivery speed. Additional charges may apply for special handling, insurance, and customs fees if applicable.

2. How can I calculate the shipping cost for my shipment?

To estimate your shipping cost, you can use online calculators provided by major carriers like UPS or USPS. Input details such as origin (10607), destination (77059), package weight, dimensions, and the desired shipping service. This will give you a preliminary estimate, though final costs may vary based on additional factors.

3. What is chargeable weight and how does it affect shipping costs?

Chargeable weight is the greater of a package’s actual weight or its dimensional weight, which is calculated based on the package’s size. Carriers use this metric to determine shipping costs, especially for lightweight but bulky items. Understanding chargeable weight helps in estimating shipping expenses more accurately.

4. What are the differences between a Bill of Lading (BOL) and an Air Waybill (AWB)?

A Bill of Lading (BOL) is a document used in land freight, serving as a receipt for goods and a contract between the shipper and carrier. An Air Waybill (AWB) is specific to air freight and serves a similar purpose but includes details relevant to air transport. Understanding these documents is crucial for effective logistics management.

5. Are there customs duties or taxes for shipping from 10607 to 77059?

Since both ZIP codes are within the United States, there are typically no customs duties or taxes for domestic shipments. However, additional fees may apply for certain items or if your shipment crosses state lines, so it’s best to verify with your carrier.

6. What shipping options are available for sending packages from 10607 to 77059?

Various shipping options include UPS Ground, UPS Next Day Air, USPS Priority Mail, and FedEx services. The choice depends on your budget, delivery time requirements, and the nature of the items being shipped.

7. How can businesses reduce shipping costs when sending packages?

Businesses can reduce shipping costs by consolidating shipments, using regional carriers for shorter distances, negotiating rates with carriers, utilizing flat-rate shipping options, and optimizing packaging to reduce weight and size.

8. What is the significance of a customs bond in shipping?

A customs bond is a contract between the shipper and the government that guarantees duties and taxes will be paid. It is required for international shipments but is generally not applicable for domestic shipping from 10607 to 77059.

9. How long does shipping typically take from 10607 to 77059?

Shipping times vary based on the selected service. For example, UPS Ground may take 1-5 business days, while expedited options like UPS Next Day Air can deliver as soon as the next business day. Always check with your carrier for specific transit times.

10. What should I do if my shipment is delayed or lost?

If your shipment is delayed or lost, contact your carrier immediately. Most carriers have tracking systems in place, and you can file a claim for lost items if necessary. It’s essential to keep all shipping documents and tracking information handy for a smoother resolution process.

Conclusion: Key Takeaways for Successful Shipping

Effective Planning for Shipping Success

Successful shipping from 10607 to 77059 demands meticulous planning. Start by understanding your shipment’s specific requirements, including dimensions, weight, and destination regulations. This foundational knowledge will not only streamline the process but also help in accurately estimating costs, which can vary significantly based on these factors.

Choosing the Right Partners

Selecting reliable shipping partners is crucial for smooth logistics operations. Evaluate various freight forwarders and carriers, considering their expertise in international shipping, customer service, and pricing structures. Engaging partners who offer a range of services—from express delivery options to specialized handling—will provide flexibility and efficiency tailored to your business needs.

Understanding and Managing Costs

A comprehensive grasp of shipping costs is essential for budgeting and financial planning. Utilize tools like shipping calculators from providers such as UPS and USPS to obtain accurate quotes. Be mindful of additional charges that may arise, such as customs duties, insurance, and handling fees. Understanding these elements will empower you to make informed decisions and avoid unpleasant surprises.

Call to Action

In conclusion, successful shipping hinges on thorough planning, collaboration with the right partners, and a solid understanding of costs. As you prepare to navigate the complexities of international shipping, take proactive steps to gather information, assess your options, and leverage available resources. Empower your business by establishing a robust shipping strategy today, ensuring your products reach their destinations safely and efficiently. Start by connecting with logistics experts and exploring the best shipping solutions tailored to your unique needs. Your journey towards seamless shipping begins now!

Important Disclaimer

⚠️ Important Disclaimer

The information in this guide is for educational purposes only and does not constitute professional logistics advice. Rates, times, and regulations change frequently. Always consult with a qualified freight forwarder for your specific needs.