The Definitive Guide to Shipping To Germany From Usa: Rates, Transi…

Your Complete Guide to shipping to germany from usa

Navigating the Complexities of Shipping to Germany from the USA

Shipping goods internationally can often feel like navigating a labyrinth, especially when the destination is as pivotal as Germany. For businesses in the USA, the challenge intensifies due to intricate customs regulations, varying shipping methods, and fluctuating costs. Whether you are an importer looking to bring products into the U.S. market or an exporter seeking to distribute your goods in Europe, understanding the nuances of shipping to Germany is crucial for operational efficiency and cost-effectiveness.

One of the most significant hurdles businesses face is selecting the right shipping method that aligns with their specific needs. With options ranging from express couriers to traditional postal services, the choice can impact delivery speed, reliability, and overall costs. Each method comes with its own set of advantages and limitations, making it essential to evaluate them carefully based on your shipment’s urgency and budget.

Costs are another critical consideration. Shipping rates to Germany can vary widely depending on factors such as package weight, dimensions, and the shipping service chosen. Businesses must also factor in additional expenses like customs duties, taxes, and insurance. Understanding these costs upfront can prevent unexpected financial burdens down the line.

Transit times are equally important, particularly for businesses dealing with time-sensitive shipments. Knowing how long your packages will take to reach Germany allows for better planning and customer communication. With various shipping options available, transit times can range from a few days to several weeks, and selecting the right balance between speed and cost is vital.

Customs clearance is often the most daunting aspect of international shipping. Germany, as a member of the European Union, has stringent customs regulations that require detailed documentation and compliance with specific import rules. Failing to adhere to these regulations can lead to delays, fines, or even the return of goods. Understanding what paperwork is required, including customs forms and declarations, is essential for a smooth shipping experience.

Finally, it is crucial to acknowledge the risks associated with international shipping. From potential damage during transit to issues with customs, the challenges are manifold. However, with the right knowledge and preparation, businesses can mitigate these risks effectively.

In this comprehensive guide, you will gain expert insights into shipping to Germany from the USA, covering essential areas such as shipping methods, costs, transit times, customs procedures, and risk management strategies. By the end of this guide, you will be equipped with the knowledge and tools necessary to navigate the complexities of international shipping efficiently, ensuring that your goods arrive in Germany on time and within budget.

Table of Contents

- Your Complete Guide to shipping to germany from usa

- Understanding Your Shipping Options: A Detailed Comparison

- Deconstructing the Cost: A Full Pricing Breakdown

- Transit Time Analysis: How Long Will It Take?

- Navigating Customs Clearance: A Step-by-Step Guide

- A Practical Guide to Choosing Your Freight Forwarder

- Incoterms 2020 Explained for Shippers

- Risk Management: Identifying and Mitigating Common Shipping Problems

- Frequently Asked Questions (FAQs) for shipping to germany from usa

- Conclusion: Key Takeaways for Successful Shipping

- Important Disclaimer

Understanding Your Shipping Options: A Detailed Comparison

Overview of Shipping Methods to Germany from the USA

When considering shipping options from the USA to Germany, businesses must assess various transportation methods based on their specific needs, such as delivery speed, cost efficiency, and shipment volume. Each method has its unique advantages and disadvantages, making it essential to choose the one that aligns with your shipping requirements. Below is a comparative table highlighting the primary shipping methods available for this route.

| Shipping Method | Best For | Speed | Cost Level | Key Advantages | Key Disadvantages |

|---|---|---|---|---|---|

| Sea FCL | Large shipments | 20-40 days | Low | Cost-effective for bulk; large capacity | Slow delivery; longer lead times |

| Sea LCL | Smaller shipments | 20-40 days | Medium | Flexible for varying sizes; shared container costs | Higher per-unit cost; potential delays |

| Air | Urgent shipments | 1-5 days | High | Fast delivery; reliable tracking options | Expensive; weight limitations |

| Rail | Heavy, bulk goods | 10-20 days | Medium | Eco-friendly; cost-effective for heavy loads | Limited routes; slower than air |

| Express | Time-sensitive packages | 1-3 days | Very High | Fastest delivery; comprehensive tracking | Very expensive; size and weight restrictions |

Detailed Breakdown of Each Method

Sea Freight (Full Container Load – FCL)

What it is: Shipping goods in a full container, typically 20 or 40 feet, making it ideal for large shipments.

When to use: Choose FCL when you have enough cargo to fill a container, as this method is cost-effective for bulk shipments.

Pros:

– Economical for large quantities.

– Secure transportation, minimizing damage risk.

– Less susceptible to fuel price fluctuations compared to air freight.

Cons:

– Longer transit times (20-40 days).

– Requires more planning due to port schedules and potential customs delays.

– Limited flexibility in terms of shipment size.

Sea Freight (Less than Container Load – LCL)

What it is: Shipping smaller volumes of cargo that do not fill a full container, allowing multiple shipments to share container space.

When to use: Ideal for businesses with smaller shipments that do not warrant the cost of an entire container.

Pros:

– Flexible for varying shipment sizes.

– Cost-effective compared to FCL for small shipments.

– Reduces storage costs as goods can be shipped as needed.

Cons:

– Higher cost per unit compared to FCL.

– Longer transit times due to consolidation and deconsolidation processes.

– Possible delays in customs clearance.

Air Freight

What it is: Transporting goods via air, providing the fastest delivery options available.

When to use: Best for time-sensitive shipments, such as perishable goods or urgent documents.

Pros:

– Fast delivery (1-5 days).

– Reliable tracking options.

– Reduced risk of theft and damage due to strict handling procedures.

Cons:

– High shipping costs, often prohibitive for large shipments.

– Weight restrictions and dimensional limitations.

– Limited capacity for oversized items.

Rail Freight

What it is: Using trains to transport bulk goods, particularly effective across continental land routes.

When to use: Suitable for heavy and bulk shipments that are not time-sensitive.

Pros:

– Cost-effective for heavy shipments.

– Environmentally friendly compared to road transport.

– Steady transit times, less prone to delays.

Cons:

– Limited route options, often requiring further transport methods.

– Slower than air freight, with transit times of 10-20 days.

– Requires coordination with other transport modes for final delivery.

Express Shipping

What it is: A premium service offering the fastest delivery times, typically provided by companies like FedEx, UPS, or DHL.

When to use: Ideal for critical shipments that require immediate delivery.

Pros:

– Fastest delivery method (1-3 days).

– Comprehensive tracking and customer service support.

– Guarantees delivery times, often with money-back options.

Cons:

– Very high costs, making it impractical for large or low-value shipments.

– Size and weight restrictions may limit options.

– Potential for customs delays, despite expedited processing.

Special Considerations

Multimodal Transport

Multimodal transport involves using two or more modes of transport to move goods from the point of origin to the destination. This approach can provide significant benefits, such as reduced transit times and cost savings by optimizing routes. For instance, a shipment could travel by rail to a port, then by sea to Germany, and finally by truck to the final destination. This flexibility is especially beneficial for businesses looking to balance cost and speed.

Specialized Options

-

Roll-on/Roll-off (RoRo): This method is used primarily for vehicles and heavy machinery. Ships designed for RoRo transport allow vehicles to be driven on and off the vessel, making loading and unloading efficient. While RoRo is generally cost-effective, it may not be suitable for all types of cargo.

-

Break Bulk: This refers to cargo that must be loaded individually and not in containers. It is used for oversized items that cannot fit in standard containers. Break bulk can be more expensive and time-consuming due to the need for specialized handling and loading procedures.

Conclusion

Choosing the right shipping method for transporting goods from the USA to Germany requires careful consideration of various factors, including shipment size, urgency, and budget. By understanding the pros and cons of each option, businesses can make informed decisions that align with their logistical needs. Whether opting for the cost-effectiveness of sea freight or the speed of air freight, the right choice can enhance operational efficiency and customer satisfaction.

Deconstructing the Cost: A Full Pricing Breakdown

Understanding the Cost Components of Shipping to Germany from the USA

When shipping goods internationally, particularly from the USA to Germany, it’s essential to understand the various cost components involved in the process. Each shipment incurs a series of charges that can significantly affect your overall logistics budget. Below, we break down these costs into three primary categories: Main Freight, Origin Charges, and Destination Charges.

Main Cost Components

Main Freight

The main freight cost is the primary expense associated with transporting goods from the origin to the destination. This cost can vary significantly based on the chosen mode of transport—air, sea, or land.

- Air Freight: Generally faster but more expensive. Pricing is typically based on weight (cost per kilogram) and volume (dimensional weight).

- Sea Freight: More economical for larger shipments, with costs determined by container size (e.g., 20ft or 40ft containers) or less than container load (LCL) pricing, which charges based on the volume of goods.

Factors influencing main freight costs include:

– Weight and Volume: Heavier and bulkier items incur higher costs.

– Shipping Distance: Longer distances increase freight charges.

– Shipping Mode: Air freight is usually more expensive than sea freight.

– Market Demand: Seasonal demand can affect rates.

Origin Charges

Origin charges encompass costs incurred before the goods leave the shipping point. These may include:

- Packing and Handling Fees: Costs for preparing the goods for shipment.

- Transportation to Port/Airport: Charges for moving the goods from the warehouse to the shipping port or airport.

- Documentation Fees: Costs associated with preparing necessary shipping documents, such as invoices and customs declarations.

- Export Duties and Taxes: Depending on the nature of the goods, there may be export tariffs.

Factors influencing origin charges include:

– Type of Goods: Certain products may require special handling or documentation.

– Warehouse Location: Proximity to major shipping hubs can impact transport costs to the port.

Destination Charges

Once the goods arrive in Germany, various destination charges may apply, including:

- Customs Duties and Taxes: Import duties are levied based on the value of the goods and their classification under the Harmonized System (HS) code.

- Unloading Fees: Charges for unloading the goods at the destination port or airport.

- Handling Fees: Costs for moving the goods from the port/airport to the final delivery point.

- Delivery Charges: Fees for transporting the goods from the arrival point to the final destination.

Factors influencing destination charges include:

– Customs Regulations: Different goods face varying duty rates and regulations.

– Delivery Distance: Costs may vary based on how far the final destination is from the port.

Example Pricing Table

Below is a sample pricing table that outlines estimated costs for sea freight and air freight. Please note these are rough estimates and actual prices may vary based on current market conditions, specific shipment details, and service providers.

| Shipping Mode | 20ft Container | 40ft Container | LCL (per CBM) | Air Freight (per kg) |

|---|---|---|---|---|

| Cost Estimate | $1,200 – $2,000 | $2,000 – $3,500 | $100 – $150 | $5.00 – $10.00 |

Disclaimer: The prices in this table are estimates and may vary based on factors such as fuel prices, shipping routes, and service providers. Always consult with a freight forwarder for precise quotes tailored to your shipment.

How to Reduce Costs

-

Consolidate Shipments: If possible, combine multiple shipments into one to take advantage of bulk shipping rates and reduce overall costs.

-

Choose the Right Shipping Mode: Analyze your shipment needs carefully. For non-urgent deliveries, sea freight is often more economical than air freight.

-

Negotiate Rates: Building a relationship with your freight forwarder can lead to better rates, especially if you ship frequently or in large volumes.

-

Optimize Packaging: Ensure your goods are packaged efficiently to minimize weight and volume, reducing shipping costs.

-

Stay Informed About Customs Regulations: Understanding the customs process can help you avoid unexpected delays and fees. Ensure all documentation is accurate and complete.

-

Consider Off-Peak Shipping: Shipping during off-peak seasons can lead to lower freight rates due to reduced demand.

-

Use Technology: Utilize logistics management software to track shipments and optimize routes, which can lead to cost savings.

By understanding the various cost components involved in shipping to Germany from the USA and implementing strategic cost-reduction methods, businesses can effectively manage their international shipping budgets.

Transit Time Analysis: How Long Will It Take?

Understanding Transit Times for Shipping to Germany from the USA

When shipping goods from the USA to Germany, understanding transit times is crucial for effective logistics management. Several factors can significantly influence how long a shipment will take to arrive at its destination. Here, we will explore these variables and provide estimated transit times for various shipping methods.

Factors Influencing Transit Time

-

Shipping Mode: The choice between air freight and sea freight is the most significant determinant of transit time. Air freight is typically much faster, with delivery times ranging from 3 to 10 business days, depending on the service level chosen. In contrast, sea freight can take anywhere from 20 to 40 days, influenced by the specific shipping route and port operations.

-

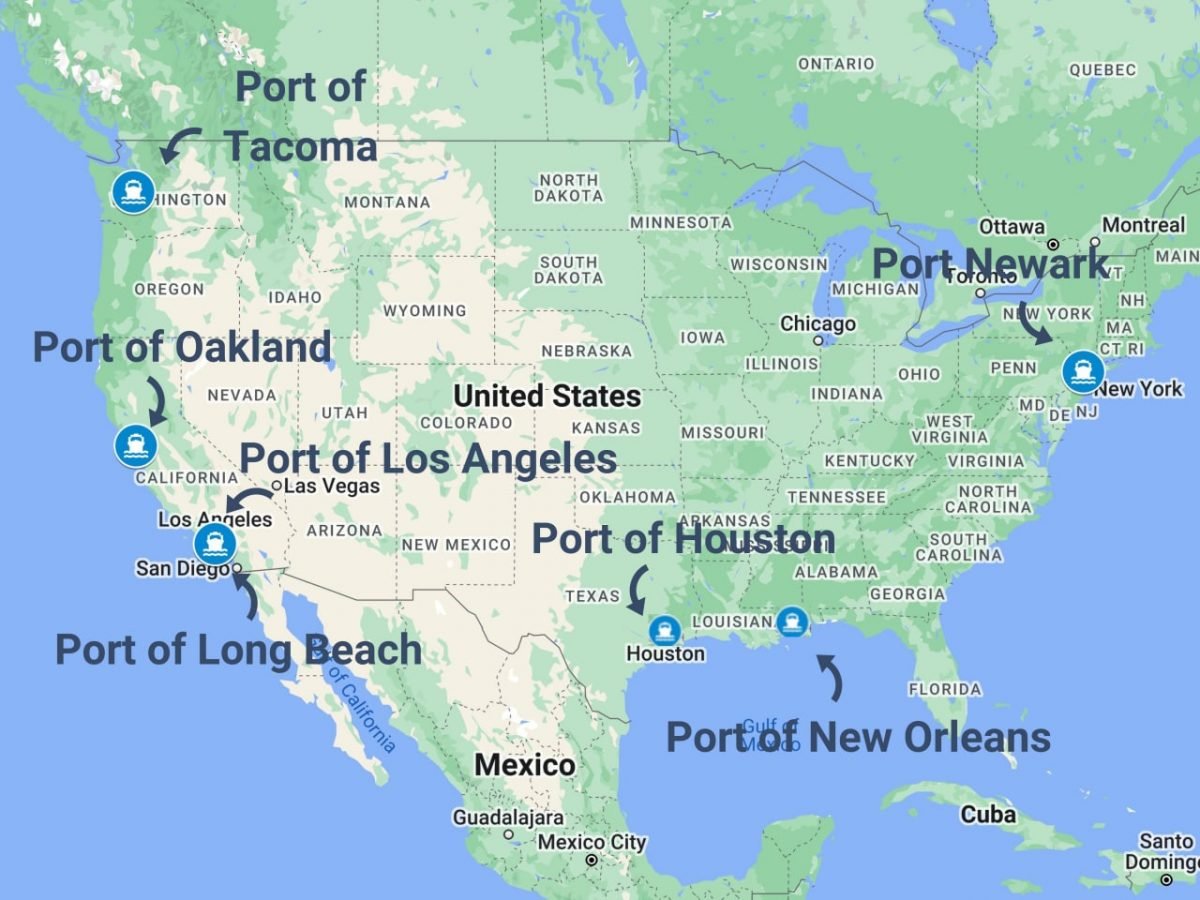

Port Congestion: Congestion at ports can lead to delays in unloading containers and processing shipments. Major ports like Hamburg or Bremerhaven in Germany may experience bottlenecks, especially during peak shipping seasons or when multiple vessels arrive simultaneously.

-

Customs Clearance: Customs procedures can vary significantly between shipments. Well-prepared documentation and compliance with both U.S. and EU regulations can expedite the process. However, delays can occur due to missing paperwork, incorrect declarations, or random inspections, which can add several days to the transit time.

-

Shipping Routes: The specific route taken can also impact transit times. Direct routes are generally faster, but if a shipment requires transshipment (transfer between different carriers), additional time may be needed for handling and transfer.

-

Weather Conditions: Inclement weather can disrupt shipping schedules, particularly for air freight. Storms, fog, or other adverse conditions can lead to flight cancellations or delays, while sea freight may also be affected by rough seas.

Estimated Transit Time Table

Here’s a practical overview of estimated transit times for shipping from the USA to Germany, based on various methods:

| Origin | Destination | Sea Freight (Days) | Air Freight (Days) |

|---|---|---|---|

| New York | Hamburg | 25-35 | 5-7 |

| Los Angeles | Bremerhaven | 30-40 | 6-8 |

| Chicago | Frankfurt | 28-38 | 4-6 |

| Atlanta | Munich | 27-37 | 5-7 |

| Dallas | Stuttgart | 30-40 | 6-8 |

Context and Explanation

The transit times provided in the table represent typical estimates for port-to-port shipping. For instance, air freight from New York to Hamburg might take 5 to 7 days, while sea freight for the same route could range from 25 to 35 days. It’s important to note that these estimates can vary based on the factors outlined above.

When planning shipments, businesses should always account for potential delays, especially with customs clearance and port congestion. It’s advisable to allow for extra time beyond the estimated transit periods, particularly when shipping high-value or time-sensitive goods. Additionally, working with a reliable logistics partner can help streamline the shipping process, ensuring that all documentation is in order and that you are informed of any potential delays.

By understanding these variables and planning accordingly, businesses can better manage their supply chains and ensure timely deliveries to their customers in Germany.

Navigating Customs Clearance: A Step-by-Step Guide

The Process Explained

When shipping goods from the USA to Germany, navigating customs clearance is a crucial step that ensures your shipment arrives smoothly and without unnecessary delays. Here’s a step-by-step guide to help you understand the process:

-

Preparation Before Shipping: Before you even consider shipping, familiarize yourself with Germany’s customs regulations. Research the types of goods you are sending and check if there are any restrictions or specific requirements for those items.

-

Collect Necessary Documentation: Gather all essential documents required for customs clearance. This includes invoices, packing lists, and any other forms that may be necessary. Accuracy and completeness in these documents are vital to avoid delays.

-

Choose a Shipping Method: Select a shipping method that aligns with your needs. Options may include express services for urgent shipments or standard shipping for less time-sensitive deliveries. Each method has different customs processing times and costs.

-

Submit Customs Declaration: When your shipment arrives in Germany, a customs declaration must be submitted. This document provides customs officials with detailed information about the shipment, including the value of the goods and their classification.

-

Duties and Taxes Assessment: Customs will assess duties and taxes based on the declared value and classification of the goods using Harmonized System (HS) codes. Be prepared to pay these fees, as they can vary significantly depending on the type of goods.

-

Customs Inspection (if applicable): In some cases, customs may inspect your shipment to ensure compliance with regulations. This can lead to delays, so it’s best to ensure your documentation is complete and accurate to minimize the likelihood of an inspection.

-

Release of Goods: Once customs clearance is completed and all duties/taxes are paid, your goods will be released for delivery. At this point, your shipment can continue to its final destination within Germany.

Essential Documentation

Proper documentation is key to a smooth customs clearance process. Below are the essential documents required when shipping to Germany:

-

Commercial Invoice: This is a bill for the goods being shipped, detailing the items, their value, and the terms of sale. It is crucial for determining customs duties and taxes.

-

Packing List: This document outlines the contents of the shipment, including the quantity and description of each item. It assists customs officials in verifying the contents against the commercial invoice.

-

Bill of Lading (BOL): This is a legal document between the shipper and the carrier that outlines the terms of transportation. It serves as a receipt of freight services and may also function as a document of title.

-

Customs Declaration: A formal statement to customs authorities that provides information about the goods being imported. This document must include the value of the goods, their classification, and the origin.

-

Certificates of Origin (if applicable): Some goods may require a certificate of origin, which certifies the country in which the goods were manufactured. This can affect tariff rates.

Duties, Taxes, and HS Codes

Understanding duties, taxes, and HS codes is essential for calculating the total costs associated with importing goods into Germany.

-

Harmonized System (HS) Codes: HS codes are standardized numerical codes used globally to classify goods. Each type of product has a specific code, which customs authorities use to determine applicable duties and taxes. It’s crucial to accurately classify your goods using the correct HS code to avoid penalties and ensure proper duty assessment.

-

Duties and Taxes Calculation: Customs duties in Germany are calculated based on the value of the goods (CIF – Cost, Insurance, and Freight) and the applicable HS code. The VAT (Value Added Tax) is also charged on imports, typically set at 19% for most goods. Understanding these rates helps businesses budget for total import costs.

Common Problems & Solutions

Navigating customs clearance can come with its challenges. Here are some common issues and solutions to help you avoid them:

- Incomplete Documentation: One of the most frequent causes of delays is insufficient or inaccurate documentation.

-

Solution: Double-check all documents for accuracy and completeness before shipping. Consider consulting a customs broker if you’re unsure.

-

Incorrect HS Code Classification: Misclassification of goods can lead to incorrect duty assessments and potential fines.

-

Solution: Research the correct HS code for your products or seek assistance from a customs expert to ensure compliance.

-

Unforeseen Duties and Taxes: Businesses sometimes underestimate the total costs associated with duties and taxes, leading to budget overruns.

-

Solution: Use a duty calculator or consult with customs professionals to get a clear estimate of potential costs before shipping.

-

Customs Inspections: Random inspections can delay shipments significantly.

-

Solution: Ensure all documentation is in order and that your goods are compliant with regulations to minimize the chances of inspection.

-

Shipping Restrictions: Certain items may be restricted or prohibited from import into Germany.

- Solution: Research specific regulations regarding your goods before shipping to avoid confiscation or fines.

By following this guide, international shippers can better navigate the customs clearance process when shipping to Germany from the USA, ensuring a smoother and more efficient experience.

A Practical Guide to Choosing Your Freight Forwarder

Understanding Your Freight Forwarding Needs

When shipping goods from the USA to Germany, choosing the right freight forwarder is crucial for a smooth logistics experience. Freight forwarders act as intermediaries between shippers and carriers, managing the entire shipping process, including documentation, customs clearance, and transportation. To make an informed choice, you should consider several key qualities, follow a systematic sourcing checklist, and be aware of potential red flags.

Key Qualities of a Reliable Freight Forwarder

-

Experience and Expertise

Look for a freight forwarder with a proven track record in international shipping, particularly to Germany. Their experience can significantly impact the efficiency of your shipping process. A forwarder familiar with the German market will understand local regulations, customs requirements, and best practices, which can save you time and money. -

Strong Network

A well-established freight forwarder should have a robust network of carriers, customs brokers, and agents in both the USA and Germany. This network ensures that your shipments are handled efficiently and can expedite the customs clearance process. A global presence can also provide you with more options for transportation modes and routes. -

Licensing and Certifications

Verify that the freight forwarder holds the necessary licenses and certifications. In the USA, they should be licensed by the Federal Maritime Commission (FMC) and have a valid International Air Transport Association (IATA) certification if they handle air freight. In Germany, compliance with EU regulations is essential. Ensure they also have adequate insurance coverage to protect your shipments against loss or damage. -

Effective Communication

A reliable freight forwarder must maintain open lines of communication. They should provide timely updates on your shipment’s status and be readily available to answer your questions. Clear communication is vital, especially when dealing with customs documentation and potential issues that may arise during transit. -

Value-Added Services

Consider freight forwarders that offer additional services such as warehousing, packaging, and logistics consulting. These services can streamline your supply chain and reduce overall shipping costs. A comprehensive service offering indicates that the forwarder is committed to meeting your unique shipping needs.

Sourcing Checklist

To ensure you select the right freight forwarder for your needs, follow this structured checklist:

-

Define Your Shipping Needs

Determine the specifics of your shipment, including dimensions, weight, value, and required delivery timelines. Understand whether you need air or sea freight and consider any special handling requirements. -

Research Potential Forwarders

Conduct thorough research to compile a list of potential freight forwarders. Look for companies that specialize in shipping to Germany and have positive customer reviews. Utilize online resources, industry forums, and recommendations from business associates. -

Request Quotes

Contact shortlisted freight forwarders to request quotes. Be sure to provide them with detailed information about your shipment to receive accurate pricing. Compare quotes based on costs, services offered, and delivery times. -

Ask Questions

Engage with potential forwarders by asking targeted questions. Inquire about their experience with similar shipments, handling of customs documentation, and their procedures for tracking shipments. Assess their responsiveness and willingness to provide detailed answers. -

Check References

Before making a final decision, ask for references from previous clients. Reach out to these contacts to gain insights into their experiences with the forwarder. Look for feedback on reliability, customer service, and any issues encountered during the shipping process.

Red Flags to Watch For

While researching and evaluating freight forwarders, be vigilant for these warning signs that may indicate a less-than-reliable partner:

-

Lack of Transparency

If a freight forwarder is unwilling to provide clear information about their services, pricing, or terms and conditions, it may be a red flag. Transparency is essential for building trust in any business relationship. -

Poor Communication

If you experience delays in responses or find it difficult to reach the forwarder, this could indicate potential issues with their customer service. Effective communication is critical for resolving issues that may arise during shipping. -

No Physical Address or Contact Information

A legitimate freight forwarder should have a physical office location and verifiable contact information. Be cautious of companies that operate solely online without a physical presence. -

Negative Reviews or Complaints

Look for feedback from other customers. If you find numerous negative reviews regarding delays, lost shipments, or poor customer service, consider these as significant warning signs. -

Unlicensed or Uninsured

Ensure that the freight forwarder is appropriately licensed and insured. Working with an unlicensed operator can expose you to legal and financial risks.

Choosing the right freight forwarder is critical for your shipping success from the USA to Germany. By understanding the key qualities to look for, following a comprehensive sourcing checklist, and being aware of potential red flags, you can make a well-informed decision that meets your business needs and ensures a smooth shipping process.

Incoterms 2020 Explained for Shippers

Understanding Incoterms

Incoterms, or International Commercial Terms, are standardized trade terms developed by the International Chamber of Commerce (ICC) to facilitate international trade. They define the responsibilities of buyers and sellers regarding the delivery of goods, including shipping, insurance, customs clearance, and risk transfer. For businesses shipping from the USA to Germany, understanding these terms is crucial for minimizing misunderstandings and ensuring compliance with international shipping regulations.

Key Incoterms Table

| Incoterm | Who Pays for Transport? | Where Risk Transfers? | Best for |

|---|---|---|---|

| EXW | Buyer | Seller’s premises | Buyers wanting minimal responsibility |

| FOB | Seller | Onboard the vessel | Sellers shipping via sea |

| CIF | Seller | Destination port | Sellers wanting to include insurance |

| DDP | Seller | Destination address | Buyers wanting maximum seller responsibility |

Detailed Explanation of Common Incoterms

EXW (Ex Works)

Under the EXW term, the seller’s responsibility ends once the goods are made available at their premises or another named place. The buyer assumes all costs and risks associated with transporting the goods from the seller’s location. This term is best suited for buyers who prefer complete control over the shipping process. For example, if a U.S. manufacturer produces machinery and makes it available at their factory in New York, the buyer is responsible for arranging and paying for all transport, including export duties, until the machinery reaches their facility in Germany.

FOB (Free On Board)

FOB indicates that the seller is responsible for all costs and risks until the goods are loaded onto the vessel at the port of shipment. From that point, the buyer assumes responsibility. This term is commonly used for sea freight. For instance, if a seller in the USA ships electronics from Los Angeles to Hamburg, they will cover transportation costs to the port and loading onto the ship. Once the goods are on board, the buyer takes over, including any shipping costs to their final destination in Germany.

CIF (Cost, Insurance, and Freight)

CIF terms obligate the seller to cover the costs of transport and insurance until the goods reach the destination port. This term is beneficial for buyers who prefer a level of risk mitigation, as the seller must provide insurance during transit. For example, if a U.S. supplier sells textiles under CIF terms to a buyer in Germany, the supplier is responsible for paying shipping fees and securing insurance for the textiles until they arrive at the port of Hamburg. The buyer takes ownership and risk once the goods reach the port.

DDP (Delivered Duty Paid)

DDP represents the maximum obligation for the seller, who is responsible for all costs and risks associated with delivering the goods to the buyer’s specified location in the destination country, including customs duties and taxes. This term is ideal for buyers who want a hassle-free experience. For instance, if a U.S. company sells software products to a client in Germany under DDP terms, the seller will handle all logistics, including shipping, customs clearance, and delivery to the client’s office, ensuring the buyer has nothing to worry about until the goods arrive.

Conclusion

Understanding Incoterms is vital for businesses engaged in international shipping, particularly when navigating the complexities of sending goods from the USA to Germany. By choosing the appropriate Incoterm, shippers can clarify responsibilities, manage risks effectively, and streamline the entire shipping process. Whether you prefer to minimize your obligations as a buyer or maximize your control over logistics as a seller, Incoterms provide the framework necessary for successful international transactions.

Risk Management: Identifying and Mitigating Common Shipping Problems

Introduction

In the world of international shipping, particularly when sending goods from the USA to Germany, proactive risk management is crucial. Shipping involves numerous uncertainties, including regulatory changes, customs requirements, and logistical challenges. By identifying potential risks and implementing effective mitigation strategies, businesses can protect their investments, maintain customer satisfaction, and ensure compliance with international regulations. This section outlines common shipping problems faced by international shippers and provides practical strategies for managing these risks effectively.

Risk Analysis Table

Below is a comprehensive table that outlines potential risks associated with shipping to Germany from the USA, their impacts, and suggested mitigation strategies.

| Potential Risk | Impact | Mitigation Strategy |

|---|---|---|

| Cargo Damage | Financial loss, customer dissatisfaction, potential claims | – Use high-quality packaging materials. – Clearly label fragile items. – Conduct pre-shipment inspections. |

| Delays | Increased shipping costs, potential penalties, loss of business | – Choose reliable carriers with a good track record. – Implement real-time tracking to monitor shipments. – Allow buffer time in delivery schedules. |

| Customs Holds | Delayed delivery, additional storage fees, penalties | – Ensure all documentation is accurate and complete. – Stay informed about Germany’s customs regulations and tariffs. – Utilize a customs broker for expert assistance. |

| Regulatory Compliance | Fines, shipment rejections, legal issues | – Regularly review and update compliance practices. – Attend workshops or training on international trade regulations. – Consult with legal experts in international shipping. |

| Increased Shipping Costs | Reduced profit margins, budget overruns | – Negotiate rates with freight forwarders based on shipment volume. – Consider using flat-rate shipping options for predictable costs. – Monitor fuel surcharges and adjust shipping methods accordingly. |

| Theft or Loss | Financial loss, reputational damage | – Invest in security features for high-value shipments. – Use tamper-proof seals and GPS tracking. – Consider cargo insurance for added protection. |

Cargo Insurance Explained

What It Covers

Cargo insurance provides financial protection against loss or damage to goods while in transit. This coverage is essential for businesses shipping internationally, as it safeguards against various risks, including:

- Theft or Loss: Coverage for stolen or misplaced items during transit.

- Damage: Protection against physical damage caused by accidents, mishandling, or natural disasters.

- Delay: Some policies may cover financial losses incurred due to shipping delays.

Types of Cargo Insurance

-

All-Risk Coverage: This comprehensive policy covers most types of damage and loss, except for specific exclusions (like intentional damage or inherent vice).

-

Named Perils Coverage: This policy covers only the risks specifically listed in the policy, such as fire, theft, or collision.

-

General Average Coverage: This protects against losses incurred during maritime shipping when cargo is sacrificed for the safety of the vessel.

Why It’s Essential

Investing in cargo insurance is a critical step for businesses engaged in international shipping. Here’s why:

- Financial Security: It minimizes the financial impact of unexpected losses, allowing businesses to recover quickly.

- Compliance with Regulations: Some countries may require proof of insurance before allowing shipments to enter, making it a necessary component of compliance.

- Peace of Mind: Knowing that your goods are insured provides confidence in your shipping operations, allowing you to focus on other aspects of your business.

Conclusion

Effective risk management is fundamental to successful international shipping. By identifying potential risks, implementing mitigation strategies, and ensuring adequate cargo insurance, businesses can navigate the complexities of shipping from the USA to Germany with greater confidence. In an increasingly globalized market, proactive measures not only protect financial interests but also enhance customer trust and satisfaction, positioning businesses for long-term success.

Frequently Asked Questions (FAQs) for shipping to germany from usa

Frequently Asked Questions About Shipping to Germany from the USA

-

What are the shipping options available for sending packages from the USA to Germany?

There are several shipping options available, including USPS, DHL, FedEx, and UPS. Each provider offers various services based on delivery speed, cost, and package size. For instance, USPS provides Priority Mail Express International for fast delivery in 3-5 business days, while DHL and FedEx offer expedited services that can also meet urgent shipping needs. -

How long does it take for packages to arrive in Germany from the USA?

Delivery times vary based on the shipping method chosen. For example, USPS Priority Mail Express International typically takes 3-5 business days, while Priority Mail International may take 6-10 business days. DHL and FedEx can offer similar expedited services, often with real-time tracking capabilities. -

What are the customs requirements for shipping to Germany?

When shipping to Germany, customs forms are required, detailing the contents and value of the package. Ensure all items comply with German customs regulations, including any restrictions on specific goods. You may also need to include a commercial invoice for shipments valued over a certain amount. -

How is chargeable weight calculated for international shipments?

Chargeable weight is typically calculated based on either the actual weight or the dimensional weight of the package, whichever is greater. Dimensional weight is calculated by measuring the length, width, and height of the package and applying a specific divisor set by the carrier. This ensures that larger but lighter packages are charged appropriately. -

What is the difference between a Bill of Lading (BOL) and an Air Waybill (AWB)?

A Bill of Lading (BOL) is a document used in ocean freight that serves as a receipt for the cargo and a contract between the shipper and the carrier. An Air Waybill (AWB), on the other hand, is used in air freight and serves a similar purpose but is not a document of title. Both documents are essential for tracking shipments and ensuring proper delivery. -

Are there any prohibited items when shipping to Germany?

Yes, Germany has restrictions on certain items, including hazardous materials, counterfeit goods, and certain food products. It is crucial to check with customs regulations or your shipping provider for a comprehensive list of prohibited items to avoid delays or confiscation. -

What are the insurance options available for international shipments?

Most shipping carriers offer insurance options that cover loss or damage during transit. For example, USPS provides up to $100 insurance for Priority Mail International shipments, with options to purchase additional coverage. It’s advisable to assess the value of your goods and choose an insurance option that provides adequate protection. -

Do I need a customs bond when shipping to Germany?

A customs bond is generally not required for individual shipments unless you are a frequent importer or shipping high-value goods. However, if you are involved in regular importing activities, obtaining a customs bond through a licensed customs broker may streamline the process and ensure compliance with customs regulations. -

How can I track my shipment to Germany?

Most carriers provide tracking services that allow you to monitor your shipment’s progress. For example, USPS, DHL, FedEx, and UPS all offer online tracking tools where you can enter your tracking number to see the current status of your package. This feature is especially useful for international shipments, as it provides visibility throughout the shipping process. -

What should I do if my package is delayed or lost?

If your package is delayed or lost, first check the tracking information provided by your carrier. If the issue persists, contact the carrier’s customer service for assistance. They can provide insights into the status of your shipment and initiate a claim if necessary. It’s also helpful to keep all shipping documentation handy for reference during the inquiry process.

Conclusion: Key Takeaways for Successful Shipping

Strategic Planning is Essential

Successful shipping to Germany from the USA begins with meticulous planning. Understanding the shipping landscape, including delivery times and customs regulations, is crucial. Make sure to familiarize yourself with Germany’s customs requirements, as they can be stringent. Prepare accurate and detailed customs documentation to avoid delays or penalties.

Choosing the Right Shipping Partner

Selecting a reliable logistics partner can significantly impact your shipping experience. Leading companies like USPS and DHL offer tailored services that cater to different needs—whether you require expedited shipping or cost-effective solutions. Evaluate potential partners based on their network strength, pricing models, and customer service. Establishing a good relationship with your logistics provider can also lead to better rates and service enhancements over time.

Understanding Costs and Options

Shipping costs can vary greatly depending on weight, size, and delivery speed. Familiarize yourself with the pricing structures of different shipping services, such as flat-rate options and weight-based pricing. Ensure that you account for additional costs, including insurance and tracking, to protect your shipments. Always compare rates and services to find the best fit for your business needs.

Call to Action

By focusing on strategic planning, selecting the right shipping partner, and understanding the costs involved, you can streamline your shipping process to Germany and enhance your international trade operations. Don’t leave your shipping success to chance—start researching your options today and take the necessary steps to ensure smooth and efficient deliveries. Your business deserves it!

Important Disclaimer

⚠️ Important Disclaimer

The information in this guide is for educational purposes only and does not constitute professional logistics advice. Rates, times, and regulations change frequently. Always consult with a qualified freight forwarder for your specific needs.