Shipping to UK: Costs, Services, and Key Considerations

The United Kingdom, with a GDP of $3.3 trillion in 2023 and a population of 67 million, is a major market for imports like electronics, vehicles, and consumer goods. Its key ports—Felixstowe, Southampton, and London Gateway—and air hubs like London Heathrow (LHR) and Manchester (MAN) make it a critical logistics hub. Users searching for “shipping to UK” seek insights on costs, reliable providers, and navigating post-Brexit customs regulations. This guide explores sea, air, and domestic freight options from key origins (US, China, Europe), includes a comparison table, and offers tips for cost-effective shipping, addressing challenges like customs delays, port congestion, and seasonal factors. It leverages web sources (e.g., Freightos, Parcel2Go) and X posts (e.g., @RoyalMail on delays) for accuracy.

Shipping Options to UK

Shipping to the UK involves sea freight, air freight, and domestic freight (for intra-UK shipments). Sea freight includes Full Container Load (FCL), Less than Container Load (LCL), and Roll-On/Roll-Off (RoRo) for vehicles or oversized cargo. Air freight covers bulk air cargo and small parcel express services. Domestic freight includes parcel and freight delivery within the UK. Below, we outline these options.

Sea Freight: Cost-Effective for Large International Shipments

Sea freight is ideal for bulk or heavy cargo, with Felixstowe handling over 4 million TEUs annually, per @PortofLondon.

Full Container Load (FCL)

FCL offers exclusive use of a 20-foot (33.2 cubic meters) or 40-foot (67.7 cubic meters) container, suitable for shipments filling at least 50–60% of a container. From the US (New York) to Felixstowe, a 40-foot FCL costs $2,500–$4,000 (10–20 days), per Freightos. From China (Shanghai), costs are $2,000–$3,500 (25–35 days). From Europe (Rotterdam), expect $1,000–$2,000 (3–7 days). Additional fees (e.g., drayage, port charges) may add $300–$700, per Transco Cargo.

Less than Container Load (LCL)

LCL consolidates smaller shipments, ideal for volumes under 15 cubic meters. From the US, LCL costs $80–$140 per cubic meter (15–25 days), per Freightos. From China, expect $70–$130 per cubic meter (30–40 days). From Europe, costs are $50–$100 per cubic meter (5–10 days). LCL involves more handling, increasing damage risks, per Parcel2Go.

Roll-On/Roll-Off (RoRo)

RoRo is used for vehicles or heavy equipment. From the US, a standard vehicle to Southampton costs $1,200–$2,500 (10–20 days), per All Transport Depot. From China, costs are $1,500–$3,000 (25–35 days). From Europe, expect $800–$1,500 (3–7 days). UK’s RoRo facilities are efficient, per Transco Cargo.

Air Freight: Speed for Urgent International Shipments

Air freight is faster but pricier, ideal for high-value or time-sensitive goods. LHR handles over 1.7 million tons of air cargo annually.

Bulk Air Cargo

Bulk air cargo suits larger shipments, with transit times of 2–5 days from the US, 3–7 days from China, and 1–3 days from Europe. Costs, based on actual or volumetric weight (length x width x height in cm ÷ 6000), average $3.50–$5.00/kg from the US, $3.00–$4.50/kg from China, and $2.00–$3.50/kg from Europe, per Freightos Air Index. A 150 lbs shipment from the US costs $200–$350.

Small Parcel Express Services

Express couriers like Royal Mail, FedEx, UPS, DHL, and Cainiao Express are ideal for small parcels. From the US, FedEx International Priority costs $30–$60 for 1–5 lbs (2–4 days), per Easyship. From China, Cainiao Express offers 1 kg parcels at $35–$45 USD (252–324 RMB) for 10–20 days, estimated based on regional pricing (e.g., Puerto Rico: 267 RMB), adjusted for UK’s logistics. From Europe, DHL Express costs $25–$50 for 1–5 kg (1–3 days). Royal Mail’s domestic rates (e.g., London–Glasgow) are £3–10 (~$4–$13 USD) for 2 kg (1–3 days).

Domestic Freight: Efficient for Intra-UK Shipments

Domestic freight within the UK uses road, rail, or air, leveraging providers like Royal Mail and DPD.

Parcel Delivery

For small packages, Royal Mail or DPD are common. From London to Manchester (200 miles), a 2 kg parcel costs **£3–10 ($4–$13 USD)** (1–3 days), per Parcel2Go. Express options cost £8–15 (~$10–$20 USD) (1 day).

Freight Delivery

For larger shipments, road/rail freight is used. A 1,000 kg pallet from Birmingham to Edinburgh (300 miles) costs **£100–£250 ($130–$325 USD)** (2–5 days), per Transco Cargo. Air freight within the UK (e.g., London–Glasgow) costs $2–$5/kg (1 day).

Comparison of Shipping Options

Below is a comparison table of shipping options to the UK from US, China, Europe, and domestic origins, designed for clarity and visual appeal.

| Mode | Origin | Cost (Example) | Transit Time | Suitability |

|---|---|---|---|---|

| FCL (40-foot) | US | $2,500–$4,000 (NY–Felixstowe) | 10–20 days | Large shipments (e.g., machinery) |

| China | $2,000–$3,500 (Shanghai–Felixstowe) | 25–35 days | Bulk goods, cost-effective | |

| Europe | $1,000–$2,000 (Rotterdam–Felixstowe) | 3–7 days | Industrial equipment, pharmaceuticals | |

| LCL | US | $80–$140 per cbm | 15–25 days | Smaller shipments under 15 cbm |

| China | $70–$130 per cbm | 30–40 days | E-commerce, partial loads | |

| Europe | $50–$100 per cbm | 5–10 days | Mixed cargo, smaller volumes | |

| RoRo | US | $1,200–$2,500 (vehicle) | 10–20 days | Vehicles, heavy equipment |

| China | $1,500–$3,000 (vehicle) | 25–35 days | Oversized machinery | |

| Europe | $800–$1,500 (vehicle) | 3–7 days | Specialty vehicles | |

| Bulk Air Cargo | US | $3.50–$5.00/kg (150 lbs: $200–$350) | 2–5 days | High-value, time-sensitive goods |

| China | $3.00–$4.50/kg | 3–7 days | Electronics, perishables | |

| Europe | $2.00–$3.50/kg | 1–3 days | Pharmaceuticals, urgent cargo | |

| Express (FedEx) | US | $30–$60 (1–5 lbs) | 2–4 days | Urgent parcels, documents |

| Express (Cainiao) | China | $35–$45 (1 kg) | 10–20 days | E-commerce, cost-effective |

| Express (DHL) | Europe | $25–$50 (1–5 kg) | 1–3 days | High-priority small shipments |

| Parcel (Royal Mail) | Domestic | £3–10 (~$4–$13, 2 kg) | 1–3 days | Small domestic packages |

| Freight (Road/Rail) | Domestic | £100–£250 (~$130–$325, 1,000 kg) | 2–5 days | Large domestic shipments |

Notes: Costs are estimates based on web data (e.g., Freightos, Easyship, Parcel2Go) and may vary by carrier, season, and route. “cbm” = cubic meter. Cainiao Express pricing is estimated based on regional data (e.g., Puerto Rico), adjusted for UK’s logistics. GBP/USD conversion at 1.30. Domestic freight assumes no customs.

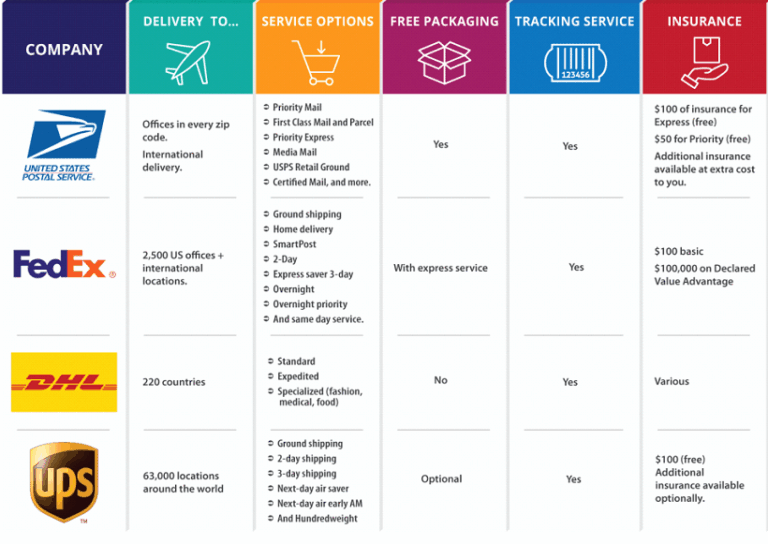

Selecting a Service Provider

Choosing a provider with UK expertise is critical due to post-Brexit customs and regulatory requirements. Below are key players and their offerings:

- Freightos: Digital platform for FCL ($1,000–$4,000), LCL, and air freight quotes, with tracking and customs support for international shipments.

- Easyship: Compares Royal Mail, FedEx ($30–$60), and DHL rates for international parcels, with automated customs forms and Brexit compliance.

- Parcel2Go: Domestic and international parcel delivery (£3–10 for 2 kg domestically, $25–$50 from Europe), with partnerships with DPD and UPS, per parcel2go.com.

- Transco Cargo: Offers FCL, LCL, and RoRo from Australia/US, with expertise in UK’s import regulations.

- Flexport: Provides FCL, LCL, and air freight from China/US, with digital tools for post-Brexit customs compliance, per flexport.com.

- Royal Mail: Domestic and international parcel delivery, ideal for small parcels (£3–10 domestically), with reliable tracking, per royalmail.com.

- Cainiao Express: Cost-effective air freight from China, with rates like $35–$45 for 1 kg (10–20 days).

Compare quotes via Freightos, Easyship, or Parcel2Go, and prioritize providers with UK-specific expertise, like Royal Mail or Flexport, for compliance.

Customs and Regulations (International Shipments)

International shipments to the UK are managed by HM Revenue & Customs (HMRC) and UK Border Force. Domestic shipments face no customs requirements.

Documentation

- Required Documents: Commercial Invoice, Bill of Lading/Airway Bill, Packing List, Certificate of Origin (if applicable), and Customs Declaration (CN22/CN23 for parcels). Post-Brexit, EU shipments require an EORI number and Customs Declaration Service (CDS) entry, per Flexport.

- Accuracy: Errors in HS codes, valuation, or documentation trigger delays or fines (up to £5,000). Use a customs broker like Flexport or Transco Cargo, per @RoyalMail.

- Special Requirements: Hazardous goods need Dangerous Goods Note (DGN). Food and agricultural products require Defra permits, per Parcel2Go.

Taxes and Duties

The UK uses the CIF method, with a £135 (~$175 USD) de minimis for duties and £15 (~$20 USD) for VAT, per HMRC.

- Import Duty: 0–25%, based on HS codes (e.g., 2–12% for electronics, 8% for clothing), per Transco Cargo.

- Value Added Tax (VAT): 20% on CIF + duty for shipments over £135. Low-value goods (under £135) incur VAT at point of sale, per Easyship.

- Customs Fees: £10–50 for inspections, per Parcel2Go.

- EU Trade Agreement: No duties for qualifying EU goods with proper origin documentation, per Freightos.

Restricted/Prohibited Items

- Prohibited: Narcotics, weapons, counterfeit goods, per HMRC.

- Restricted: Food, plants, animals, and hazardous materials require Defra or HSE permits. Medications need MHRA approval, per Royal Mail.

- Check Updates: Post-Brexit rules evolve; verify via HMRC or a broker like Flexport.

Clearance Time

Typically 1–3 days for air freight, 3–7 days for sea freight, per Flexport. EU shipments face additional Brexit-related delays (1–5 days), per @RoyalMail.

Key Considerations and Challenges

The UK’s post-Brexit landscape and busy ports pose challenges, per @PortofLondon on congestion.

Logistics Challenges

- Port Congestion: Felixstowe and Southampton face delays (2–5 days) during peak seasons (Q3–Q4), per @PortofLondon. Book early to avoid bottlenecks.

- Transit Delays: Sea freight (3–40 days) is slower than air (1–7 days). Domestic delivery to remote areas (e.g., Scottish Highlands) adds 1–3 days, per Parcel2Go.

- Brexit Impact: EU–UK shipments require extra documentation, increasing clearance times and costs, per @RoyalMail.

- Package Security: Untracked LCL or parcels risk loss. Use tracked services like FedEx/UPS or insure via Easyship, per Transco Cargo.

Seasonal and Economic Factors

- Peak Seasons: Black Friday, Christmas, and Lunar New Year (for China routes) increase rates and delays. Book 4–6 weeks early, per Flexport.

- Brexit Costs: Additional VAT and customs fees for EU shipments reduce margins, per Freightos. Use EU–UK TCA benefits for duty-free trade.

- Infrastructure: UK’s ports and airports are modern, but road congestion (e.g., M25) can delay last-mile delivery, per Parcel2Go.

Cost-Saving Tips

- Consolidation: Use LCL or parcel consolidation via Parcel2Go or Easyship to reduce costs.

- Compare Quotes: Platforms like Freightos, Easyship, or Parcel2Go offer competitive rates.

- De Minimis: Keep shipments under £135 to avoid duties, per HMRC.

- Brexit Compliance: Use an EORI number and proper origin documents for EU shipments, per Flexport.

Conclusion

Shipping to the UK requires navigating post-Brexit customs, port congestion, and seasonal challenges. International sea freight (FCL: $1,000–$4,000, LCL: $50–$140/cbm, RoRo: $800–$3,000) and air freight (express: $25–$60, bulk: $2.00–$5.00/kg) suit global shipments, while domestic freight (parcels: $4–$13, freight: $130–$325) is efficient within the UK. Providers like Freightos, Royal Mail, and Cainiao Express ($35–$45, 10–20 days from China) offer tailored solutions. By comparing rates, ensuring compliance, and planning for peak seasons, you can achieve efficient, cost-effective shipping to the UK.

For quotes, contact Freightos (freightos.com), Easyship (easyship.com), or Parcel2Go (parcel2go.com). Plan today for a seamless shipping experience.